Fraud is an ever-present danger in the modern world but in the run-up to Christmas, scammers come out in droves to exploit the gift-giving frenzy and emotions that come with the festive period.

The Financial Conduct Authority (FCA) warned earlier this month scammers will be looking to exploit the financial stress of Christmas.

Nationwide, Lloyds, Experian and HSBC have all put out warnings over the threat of scams in recent weeks.

Banks have estimated around £100 million will be lost to fraud this Christmas, with most of that coming from unauthorised fraud, where a scammer gets hold of someone’s bank details.

With that in mind, here are some of the scams to watch out for in the next few weeks.

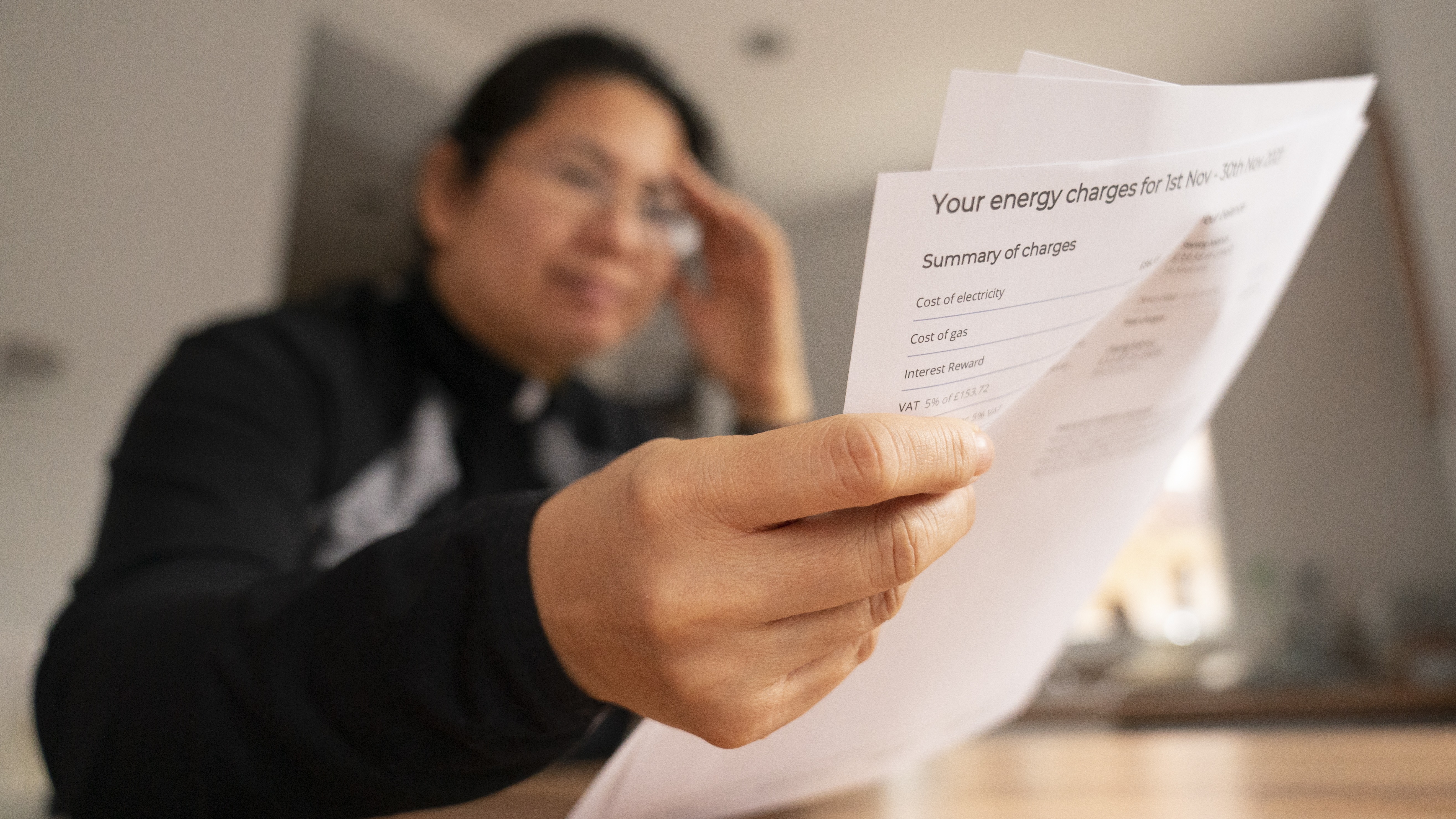

Cost of living scams

Cost of living scams have been on the rise since inflation and energy prices began spiralling.

But with budgets tight ahead of Christmas and energy prices again creeping up, people are even more vulnerable to being scammed.

Action Fraud says they have received over 350 reports of fake messages purporting to be from the UK government claiming to offer energy rebates in recent months.

People in receipt of the Energy Bill Support Scheme do not need to apply for it and it is taken directly out of the bill.

Similar schemes are being tried with cost of living payments, which are again added to people’s benefits directly without needing to apply.

The next one will be sent in February and is worth £299.

Action Fraud recommends people be wary of anything offering a discount, with most of the government’s cost of living support now over and what is left being automatic.

Be especially wary of anything offering a discount on a usually private business like a phone or internet bill.

Loan fee fraud

Following on from the cost of living scams, the FCA has warned of a rise in loan fee fraud as people seek quick cash to help with squeezed Christmas budgets.

They said 40% of UK adults were worried they would not be able to afford presents this year, rising to 52% for parents with children under 18.

The FCA said people are increasingly turning to loans to cover Christmas costs.

Loan fee fraud is when someone pays a fee for a loan they never receive, with the FCA saying the usual loss is on average £255.

The FCA advised people to be wary of being offered loans on cold calls, loans demanding upfront fees or people selling loans asking for money unusually quickly.

Missed delivery scams

If you’ve looked in your junk box lately, or even in your main inbox, you may have seen an email claiming you had missed a delivery.

Millions of emails like these have been tracked by delivery company Evri in recent months and they are becoming even more prevalent as people order Christmas presents.

A member of Evri’s Cyber Security team said: “These criminals use what we call the ‘spray and pray’ method. Sending out millions of these messages each month across a variety of different brands in hope of catching you out.”

Evri urged everyone to check the emails properly, especially from the address the emails came from, which are often just randomised letters automatically generated by the scammers.

Other tell-tale signs are a lack of any information about the contents of your parcel, the email being written poorly or looking sloppy, or not using a personal greeting and simply addressed ‘Dear customer’.

Delivery companies usually do not handle money from the customer directly, often being paid through the supplier, meaning if any supposed failed delivery warning asks for your bank details, take it with extreme caution.

Evri also said these kinds of emails try and rush you by warning the package could be lost within days if action is not taken – something delivery businesses never do.

Romance fraud

While Christmas is a happy time for many, others also struggle with loneliness during the festive period. This is something scammers exploit.

Romance scams involve a scammer getting to know someone else in order to get money out of them.

They will often feign romance and closeness in order to earn the victim’s trust before saying they need a large chunk of money for whatever reason.

Action Fraud warns that victims of romance fraud often do not wish to disclose it and people close to them should be aware of it.

They said to watch out for people who are suddenly expressing strong emotions for someone they haven’t met while also not wishing to disclose any information about them.

Action Fraud also urged people to not make financial commitments to people they had not met.

Ticket scams

Christmas pantos are part of the fun of the festive period, but as everyone rushes to buy tickets for all the events scammers are still lurking.

Over £6.7 million was lost to ticket fraud last year, with scammers pretending to offer tickets to sporting and music events.

Ticket scams often try and offer tickets through emails or text without directing the customer to a verified website.

They will also try and get potential customers to pay through bank transfer rather than a normal payment.

Jonathan Brown, Chief Executive of Society of Ticket Agents and Retailers, urged people to only buy from verified box officers and members of his society.

He said: “It’s vital that ticket buyers always keep their eyes open and take steps to protect themselves from unscrupulous ticket sellers that prey on their understandable excitement about attending some of the great events on offer.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country