The Financial Conduct Authority (FCA) is proposing that loan companies should decide who is eligible for compensation and how much they should receive, as ITV News Consumer Editor Chris Choi reports.

Drivers might not have the records needed to get motor finance compensation, the car loan industry has warned.

Millions of car owners could receive a payout after the Financial Conduct Authority (FCA) announced it would set up a compensation scheme for people who were unlawfully sold car finance, unaware their car dealership was receiving a commission from the finance company.

The regulator said many motor finance firms had not complied with the law dating back to 2007 and it would decide how affected customers should be compensated.

FCA chief executive Nikhil Rathi said the consultation process would work out the rules of the scheme, establish who should be included and how compensation should be paid.

“The loan companies will have to follow those rules to make sure they comply and if they don’t, there’ll be legal consequences for them,” he told ITV News.

“If the law has been broken, everybody should be making best efforts to put it right.”

But the director general of the Finance and Leasing Association Stephen Haddrill said the FCA needed to address the issue of missing paperwork, as many of the claims were up to 18 years old.

“We have concerns about whether it is possible to have a fair redress scheme that goes back to 2007 when firms have not been required to hold such dated information and the evidence base will be patchy at best,” he said.

Mr Rathi said the FCA would work through those issues.

“We’re going to work with firms now to work out what is operationally possible,” he explained.

“My message to everybody is instead of telling us what all the problems are, work with us on the solutions.”

“There are practical ways in which much of this can be solved.”

The FCA said most people would probably receive less than £950 in compensation.

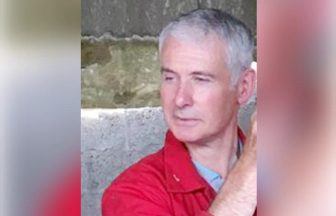

Desmond Gourde made a made a claim several years ago and received compensation after he was charged too much interest.

He said the suggested amount was too low and should be up to £3500.

“It will be nice to know that others will get something back after the mess they made,” he told ITV News.

“It should be a lot more than hundreds, a couple thousand max, considering what we’ve had to go through.”

The consultation will begin by early October and if the compensation scheme goes ahead, the first payments should be made in 2026.

According to the FCA, claimants do not need to use a claims management company or law firm to seek compensation as part of the scheme.

They can wait until the scheme has opened to register or contact their lender to make a complaint.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country