Premium Bonds odds will improve to the best level seen in more than 15 years from September, it has been announced.

NS&I (National Savings and Investments) said the odds will improve to 21,000 to one, from 22,000 to one previously – their best level since the April 2008 prize draw.

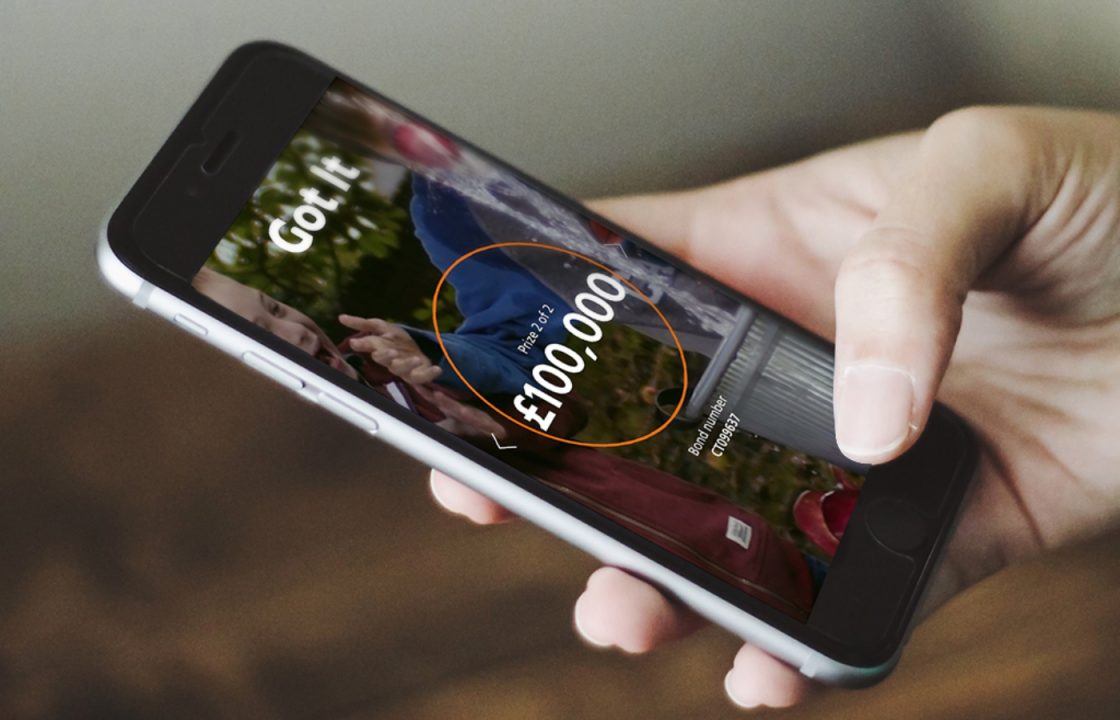

They estimated that there will be 5,785,904 prizes up for grabs from September – an increase of more than 269,000 when compared with August 2023 – but the number of £1m prizes will remain the same, at two.

There will be about 90 £100,000 prizes, up from an estimated 77 in August.

And there will be an estimated 181 £50,000 prizes in September, up from 154 in August.

While there will be more big money prizes on offer, the estimated number of £25 prizes will reduce, to 1,027,604 in September, down from 1,700,728 in August.

The prize fund rate will increase from from 4.00% to 4.65% from the September draw, marking its highest level since March 1999.

The change in odds will see an estimated extra £66m added to the prize fund next month, with a potential prize pot of more than £470m.

NS&I is backed by the Treasury. When customers invest in NS&I products, they are lending to the Government. In return, the Government pays interest or prizes for Premium Bonds.

The provider, which has more than 24 million customers, also announced improvements to some savings rates.

Among the changes, the interest rate paid to direct saver customers will increase to 3.65%, from 3.40%.

The rate paid on NS&I’s direct Isa will increase to 3.00%, from 2.40%. Young savers will also benefit, with the rate that NS&I pays on its Junior Isa increasing to 4.00%, from 3.65%.

The rates on these savings accounts will increase from August 18.

NS&I chief executive, Dax Harkins, said: “These upcoming increases show that we’re supporting savers up and down the country. Premium Bonds are one of the nation’s favourite savings products, so increasing the prize fund rate to its best level since 1999 and improving the odds means that more people will have the chance to win prizes each month.

“These rate increases will help ensure that our savings products remain attractive to customers, whilst ensuring that we continue to balance the needs of savers, taxpayers and the broader financial services sector.”

All NS&I products offer 100% capital security due to its Treasury backing.

Savings rates generally have been climbing as the Bank of England base rate has been hiked and – under a new wide-ranging consumer duty introduced last month – banks, building societies and other financial services providers must put customers at the heart of what they do and give them fair value.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

NS&I

NS&I