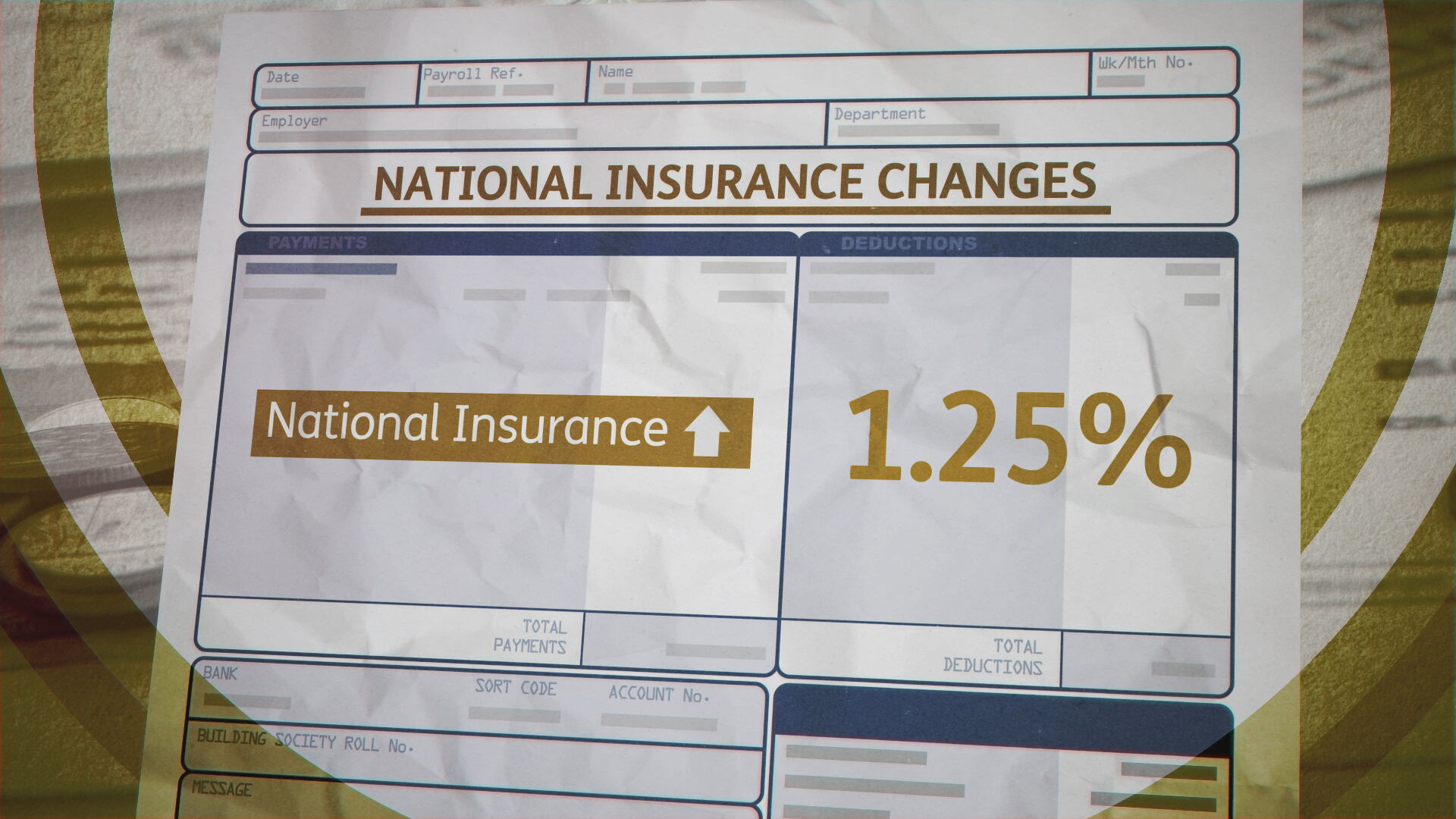

People across Scotland will notice their National Insurance (NI) contributions have increased when they next get paid, after changes announced by chancellor Rishi Sunak came into effect on Tuesday.

The move will see employees, employers and the self-employed all pay 1.25p more in the pound for NI.

STV News

STV NewsUK Government ministers say the plan is to use the extra revenues to fund the NHS, health and social care in England, but the increase is expected to raise extra money that Scotland could also choose to spend on those services.

The Scottish Government has already committed to passing on all funding received from the NI change to health services in Scotland.

It has been a controversial decision as it comes at a time when people are dealing with rising fuel, food and energy costs.

How much more will I pay in National Insurance?

Employees previously paid 12% on earnings up to £50,270 and 2% on anything above that. From April 6, the rate goes up to 13.25% and 3.25% respectively.

For the self-employed, rates will go up from 9% and 2% to 10.25% and 3.25%.

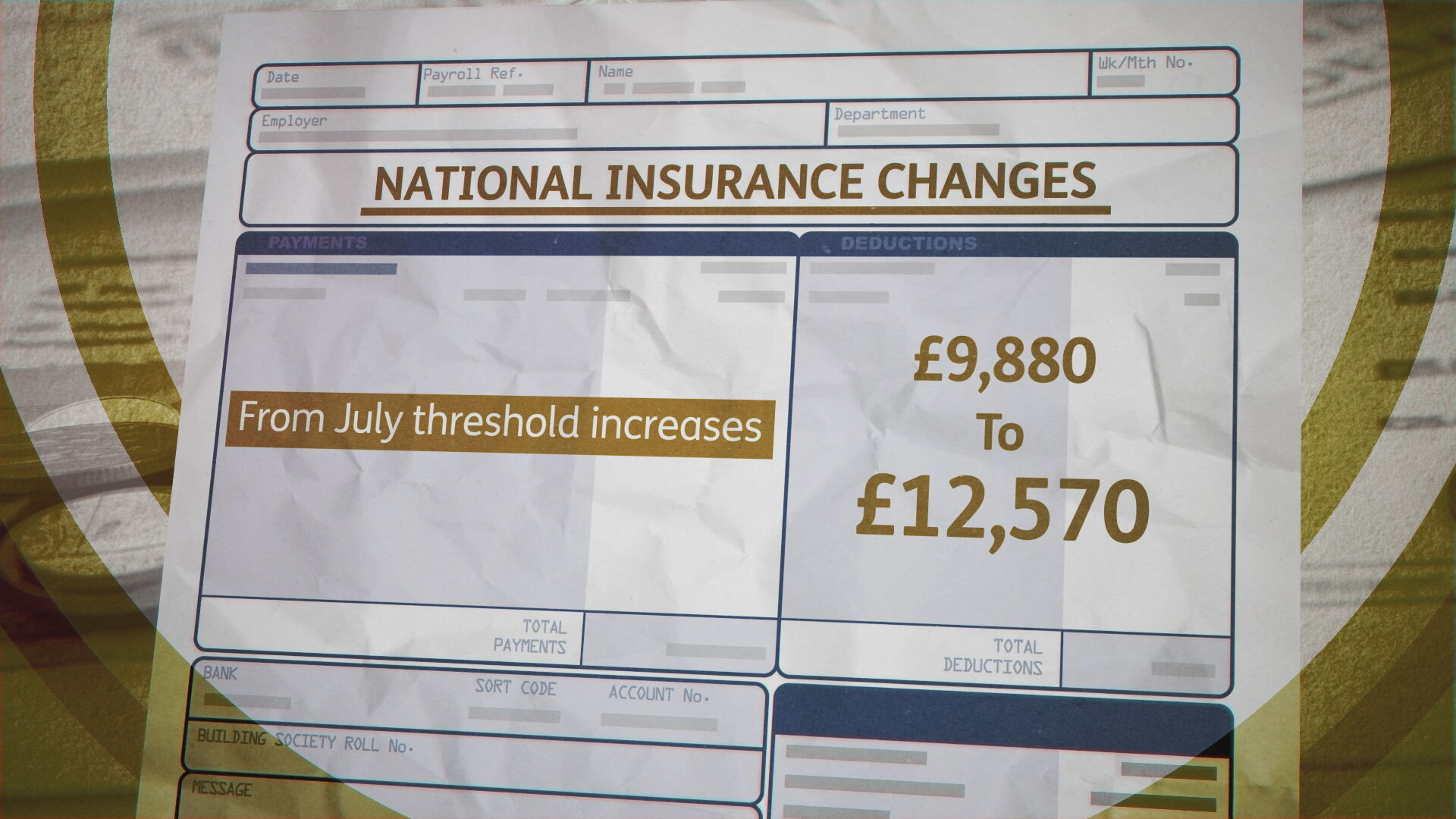

Payments will only be collected on wages above £9880, although this rises to £12,570 in July – a threshold rise announced by Sunak at the recent Spring Statement.

Why has the increase been introduced?

The UK Government says the 1.25 percentage point rise in national insurance (NI) will be spent on the NHS, health and social care in the UK.

From April 2023, the NI rate will return to the 2021-22 level, as a new health and social care levy introduced.

The tax rise could raise £39bn over the next three years, helping to reduce NHS backlogs which have been exacerbated by the coronavirus crisis.

The extra cash raised could also reduce waiting times and deliver millions more scans, tests and operations.

Has there been opposition to the changes?

Yes, opposition parties say the move is the wrong tax at the wrong time.

Kate Forbes, Scotland’s finance secretary, said: “Businesses, households, are already contending with some of the most significant tax increases on top of inflation, on top of the cost of living and energy prices.

“So, any business in Scotland is now facing the cumulative impact of significant additional costs, and that is not something that we feel we can support.

“The chancellor has other leverage to support businesses right now and he’s not using them.”

Who does it apply to and how will the increase be taken?

If you are employed, the contributions will come out of your wages before you are paid and show in your payslip.

Self-employed people pay national insurance depending on their profits and employers also pay NI contributions.

How else are households being squeezed?

This month has been dubbed “awful April” by some, as households are dealing with multiple pressures from soaring living costs.

The NI rise comes on top of a 54% increase to Ofgem’s price cap and increases to council tax and water bills, mortgages, rents, food and transport costs.

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said: “Awful April is just the beginning of an incredibly tough few months.

“The real pain of the national insurance hike will be felt on payday, at the end of the month.

“At that point, we’ll be reeling from the impact of higher energy bills, council tax, water bills, fuel costs – and we’ll have to manage it all on a smaller pay packet. It’s a terrible time to hike taxes.”

Why will people particularly feel the pinch from the NI change in the next few months?

Employees currently pay national insurance on annual earnings above £9880, but from July the threshold will increase to £12,570.

STV News

STV NewsThat rise is intended to help combat the cost of the increase for lower and average earners but won’t actually affect pay packets until the end of July.

As a result, people will particularly feel the pinch from Tuesday’s NI hike over the next few months until the threshold changes.

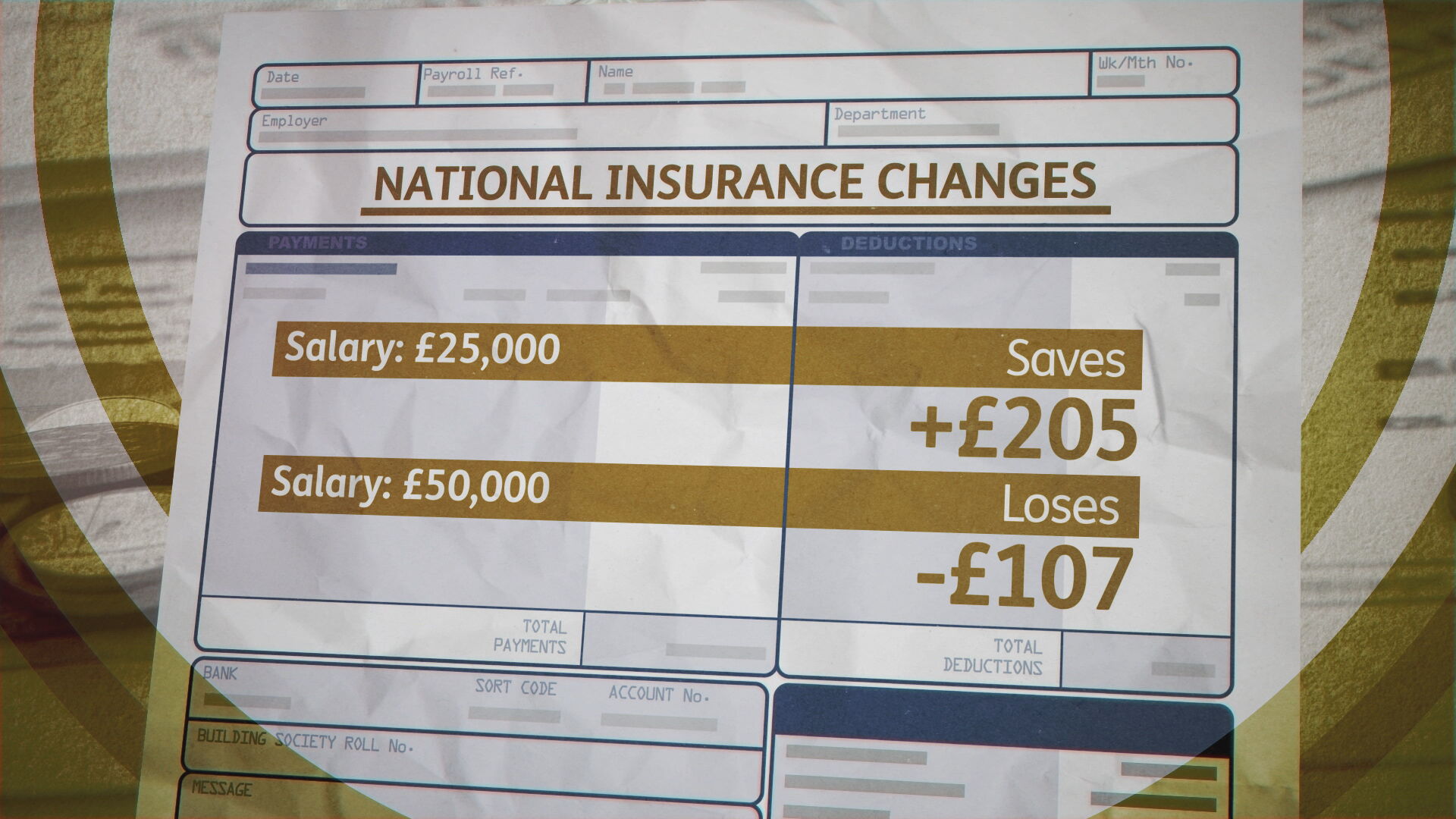

Coles explains: “While 1.25 percentage points doesn’t sound like much of an uplift, in reality it will mean someone on an average wage will pay 10% more.”

The change in the July threshold will mean those earning less than around £35,000 won’t pay as much in NI contributions.

For example, someone earning £25,000 will be better off by around £200. But someone on £50,000 will lose more than £100 per year.

STV News

STV NewsIs there anything people can do to combat the impacts of the NI hike?

Salary sacrifice schemes allow employers to reduce an employee’s salary and pay the equivalent amount into a non-cash benefit, such as pension contributions or a cycle-to-work scheme.

Adrian Lowery, personal finance expert at investing platform Bestinvest, said: “An employer could agree to contribute a greater proportion of your salary into your workplace pension, in lieu of pay.

“While pension contributions always benefit from income tax relief, if this system is used then national insurance relief is also obtained.”

He said there are downsides, however, to reducing your salary, such as decreased mortgage affordability.

Myron Jobson, senior personal finance analyst at interactive investor, warned: “A lower salary can affect entitlements such as maternity/paternity pay, mortgage applications based on one’s income, and some state allowances.

“As such, people should always consider how such benefits could impact their finances more broadly.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock