Some major banks are getting decisions about certain customer scams and reimbursement wrong in around eight in 10 cases seen by the ombudsman, according to Which?.

A “reimbursement lottery” leaves many victims facing an uphill struggle to recover their money when they have been targeted by criminals, the consumer group said.

Many banks have signed up to a voluntary reimbursement code on bank transfer scams, also known as authorised push payment fraud (APP), which instructs them to reimburse customers who are not at fault and provide them with adequate support.

However, the number of new authorised fraud complaints – the vast majority of which relate to APP scams – made to the Financial Ombudsman Service (FOS) more than doubled in 2020-21, from 3600 to 7770.

Three-quarters (73%) were upheld in favour of the customer. Authorised fraud also includes some card fraud, where the dispute is about whether the consumer authorised a payment or withdrawal with their card.

Which? said figures it had obtained from the FOS show NatWest and Royal Bank of Scotland (RBS) – which are part of the same banking group – are getting it wrong in 86% of cases, with Santander (82%) and Bank of Scotland (81%) following.

NatWest told Which?: “At NatWest, our proactive stance and relationship with FOS has brought forward the settlement of many of our cases earlier than required. As a result of this our overturn rate for the period is inflated, we do however expect to see this normalise in 2022.”

While challenger bank Starling (80%) also had a high complaint uphold rate, this was based on a much smaller number of closed cases than other firms, Which? said.

Many fraud complaints against Lloyds Bank (78%), Revolut (77%) and Nationwide (74%) are also being upheld in favour of the customer. Aside from Revolut, these banks are signed up to the voluntary scams code, according to Which?.

Which? has called for much greater transparency about firms’ behaviour and approach to reimbursement which would require banks to regularly publish data, including their reimbursement rates for all of the APP fraud cases they handle each year.

The figures also show that on average, in the last financial year, it took nine-and-a-half months for the FOS to resolve an authorised fraud complaint.

Jenny Ross, Which? Money editor, said: “Fraud can have a devastating financial and emotional impact on victims, so it’s shocking that so many banks are failing to handle cases correctly, often wrongly and unfairly denying victims reimbursement.”

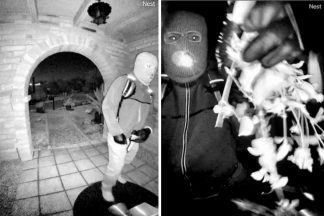

One woman told Which? she lost £7000 in just four hours after falling victim to a complex remote access scam after a caller posed as a BT engineer, but her bank Santander initially refused to refund her as it believed she willingly made the payment.

She took her complaint to the FOS, which was satisfied the woman had a reasonable basis for believing she was speaking to a genuine BT engineer. The bank had to refund her in full, plus 8% interest as compensation.

Santander told Which?: “We invest a great deal in protecting our customers against fraud, raising awareness of scams and fraud, and working closely with FOS, as well as other industry bodies, to ensure customers are treated fairly.”

Lloyds Banking Group said: “We continue to work closely with FOS to help ensure we get it right first time for our customers.”

Nationwide said: “We work openly and closely with the FOS to understand its views on these cases and continue to make enhancements to fraud/scam measures as a result.”

Revolut said: “The increase in APP fraud is an industry-wide issue… We communicate frequently with customers to help them spot and avoid fraud.”

Starling Bank questioned Which?’s conclusions, saying the number of resolved cases relating to it in the relevant period was too small to be statistically significant.

It said: “Overall, we note that, based on this data, Starling accounts for 0.6% of the cases upheld against all banks.

“Where cases are resolved one way or another, we take on board the FOS’s findings. We operate a payment review model, which we continuously seek to improve in line with scam trends with our aim to prevent customers from making fraudulent payments.”

TSB, which has its own fraud refund guarantee, said: “In contrast to these figures TSB’s fraud refund guarantee provides life-changing support to customers that are victims of fraud – where we have refunded 98% of all bank fraud cases.

“We are calling for more transparency on fraud refunds and for all banks to publicly display their refund rates, so that customers can see how likely they are to receive a refund should they ever fall victim to one of the UK’s fastest growing crimes.”

The percentages of cases upheld in consumers’ favour by the FOS after complaints were made relating to authorised fraud, according to Which?

– RBS, 86%

– NatWest, 86%

– Santander, 82%

– Bank of Scotland, 81%

– Starling Bank, 80%

– Lloyds, 78%

– Revolut, 77%

– Nationwide Building Society, 74%

– Monzo, 73%

The data covering April 1 2020 to March 31 2021 includes APP fraud as well as cases that did not involve a push payment, for example where the dispute is about whether the consumer authorised a payment with their card.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

PA Media

PA Media