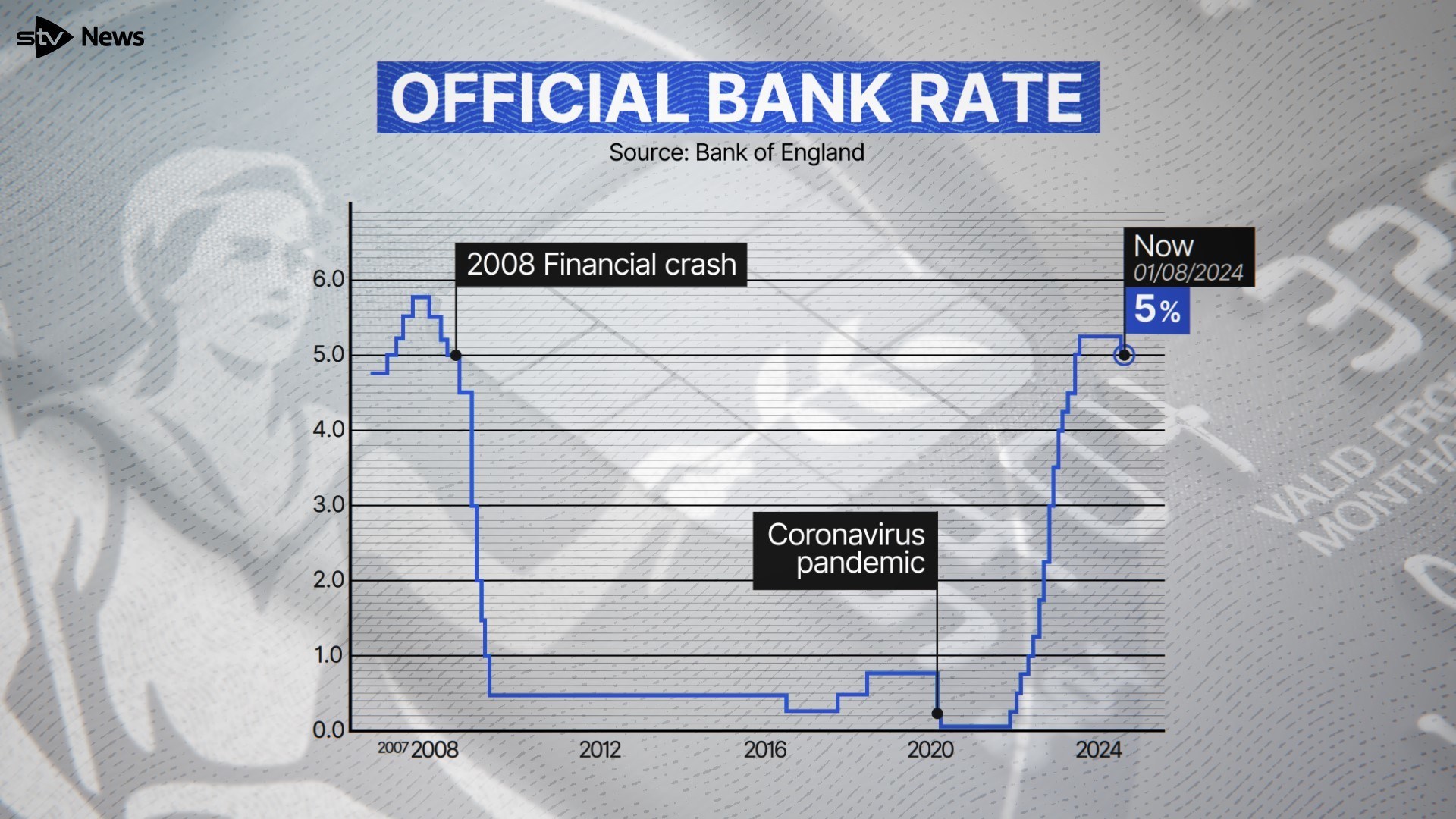

UK interest rates have been cut for the first time in more than four years, releasing some pressure on borrowers as the Bank of England was encouraged by signs that inflation has slowed.

The Bank reduced rates from 5.25% to 5%, following a split vote which saw some members of the Monetary Policy Committee (MPC) prefer to keep the level unchanged.

Governor Andrew Bailey, who voted for a cut, said “inflationary pressures have eased enough that we’ve been able to cut interest rates today”.

But he signalled that the central bank was going to be careful not to cut rates too quickly going forward.

STV News

STV NewsBorrowing costs had been held at 5.25% – the highest level in 16 years – since August last year.

Thursday’s decision marks a turning point for the Bank, which has not implemented a rate cut since the onset of the Covid-19 pandemic in 2020.

It means that while rates remain elevated, mortgage costs could start to come down further while savings rates offered by banks could be reduced.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock