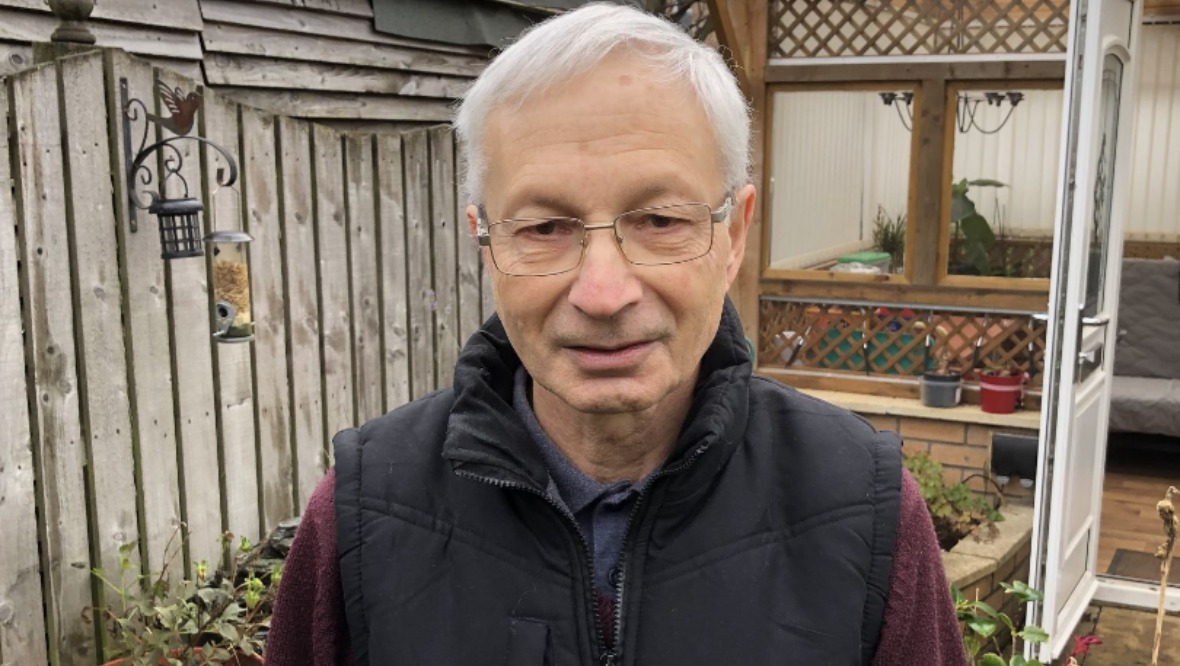

A man who lost almost £60,000 to scammers says he felt like a “zombie” after they tricked him into transferring funds from his bank accounts.

Michael Rossall, from Glasgow, was duped into making the transactions after he had reported a WiFi router fault with his internet provider.

The ordeal went on for three days, during which Michael says he lost “all independent free will” and felt like he was the scammer’s “slave”.

The retired teacher said: “I never understood how this could happen to people but I’ve been there and I’ve been a zombie for three days.”

The scammers had posed as his internet provider and told him to download security software, which turned out to be spyware.

Michael said: “Now, of course, all the warning signs should have gone on but in the heat of the moment you just do it and then they have got you.”

The scammers had gained access to Michael’s banking passwords and took money from his accounts.

They also told him he was entitled to a refund because of the fault with the router.

But when they went to make the payment they claimed they had paid him £9000 in error and would lose their jobs over it.

When he returned the money to the scammers they told him the transfer had not gone through so he continued to send them money using a number of different accounts, amounting to almost £60,000.

Colin Mathieson, from Advice Direct Scotland, said: “Very often consumers won’t just be the target of one scam.

“It will be multiple scams in order to build up a picture of the consumer so that when they are talking to the scammer they feel more confident that they are talking to a genuine person.”

“That is even more insidious – they are using sometimes three and four different methods to extract information out of the one person.”

Michael has only managed to get part of the money back as he approved most of the payments himself.

He wants banks to do more to protect customers and has set up a UK Government petition to put increased safeguards in place across all banks.

He said: “The victims are not being careless, it isn’t carelessness, you know, I’m a careful person but they know exactly what buttons to press and, you know, you come up with an objection, they’ve got an answer to it and it all sounds very convincing.”

Police Scotland is launching a campaign to help people protect themselves from fraud – which has become one of the most commonly experienced crimes in the country.

Deputy chief constable Malcolm Graham said: “Our advice is clear and the public should be aware that a telephone call, email or text may not be from the person or organisation it appears to come from.

“Never click on a link from an unsolicited email or text, and remember that banks, police or other legitimate organisations will never ask you for personal banking information or ask you to move funds to a different account.”

In regards to Michael’s case, police say they have received a report of an incident of fraud and enquiries are continuing.

For advice on how to stay scam aware go to https://www.consumeradvice.scot/.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News