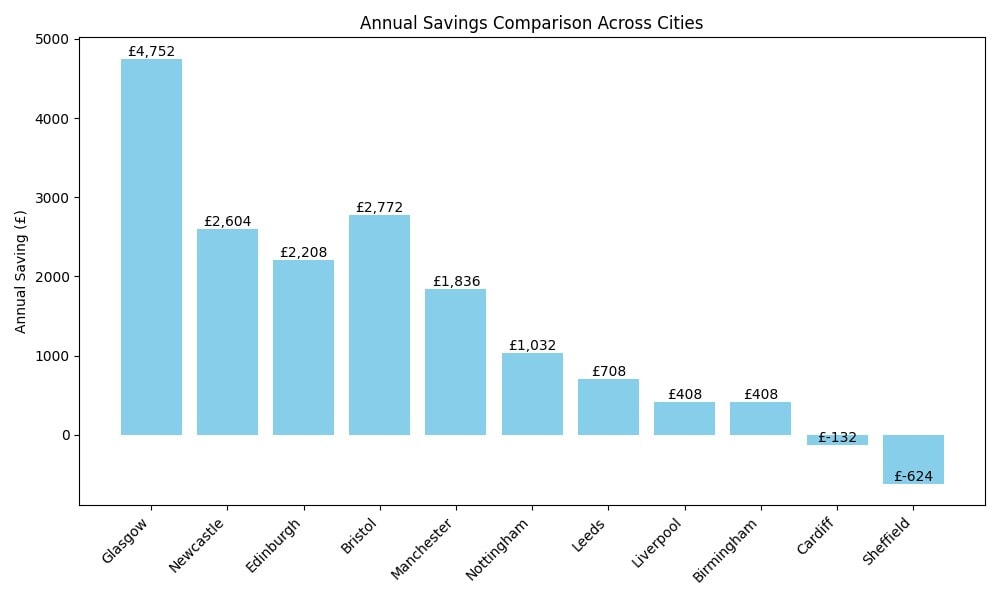

Glasgow offers the greatest saving for first-time buyers when comparing monthly rent to mortgage costs, according to analysis by a major bank.

Lloyd’s analysis found buying a home with a mortgage could be cheaper than renting in many major cities – even with a low deposit.

The bank used Office for National Statistics (ONS) data in its calculations for average first-time buyer property prices and average rental figures in 11 major cities.

In nine of those cities, homeowners would pay less each month on their mortgage than tenants spend on rent.

Glasgow came out on top, with homeowners saving an average of £396 a month, or £4,752 a year – nearly a third less than renting (31.7%).

iStock

iStockThe study suggested, based on an average first-time buyer property price of £172,000, a deposit of just £8,600 could be enough for some people to get on the ladder.

The analysis assumed a 4.78% five-year fixed rate mortgage with a 30-year repayment term and 5% deposit. It did not include other costs associated with home ownership, such as legal fees or maintenance.

London was excluded from the analysis due to significantly higher property prices there and different affordability dynamics, Lloyds said.

Across the 11 cities, a typical 5% deposit needed could be around £11,412, based on an average first-time buyer property price of £228,233, the research found.

Newcastle was placed second for savings, with first-time buyers paying 20% less on average for a mortgage than they would for rent, making a potential monthly saving of £217, or £2,604 a year.

The average first-time buyer home there costs £180,000, meaning a deposit of £9,000 could secure a property.

Even in cities such as Cardiff and Sheffield, where renting worked out slightly cheaper in the short-term, the longer-term benefit of building up equity in the property could outweigh the difference, the report suggested.

STV News

STV NewsAmanda Bryden, head of mortgages at Lloyds, said: “We know that saving for a deposit is one of the biggest hurdles for first-time buyers.

“With rents having risen sharply over the last two years, many are already managing monthly payments that are higher than a typical mortgage.

“That’s why low-deposit mortgages could be the right solution for many – helping people move from renting to owning sooner than they thought possible.

“It’s also important to consider other upfront costs like legal fees and moving expenses – but for most, the long-term savings will outweigh these.”

While buying may be cheaper than renting in some circumstances, some people may prefer to rent for reasons such as having more flexibility and to be able to move around for work.

Ms Bryden added: “The impact of growing equity in your own home – money that would otherwise have been lost in rent – means a more secure financial future.

“For anyone thinking about buying, speaking to a mortgage adviser or broker is a great first step.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock