A criminal behind one of the UK’s largest ever carousel tax frauds has been convicted after living a “lavish” lifestyle at the expense of the taxpayer after a van full of fake goods was seized by Scottish police.

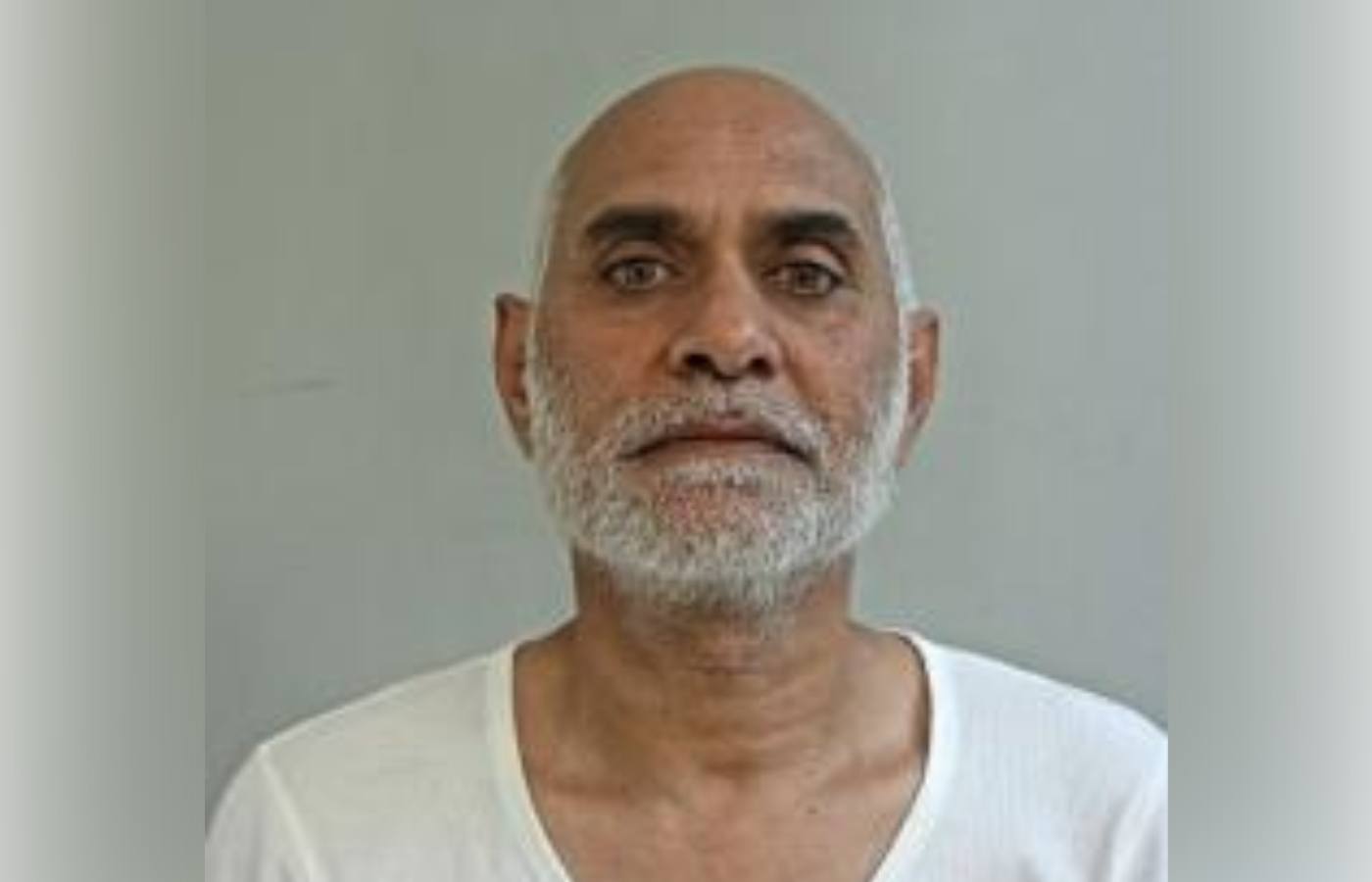

Arif Patel, a sock manufacturer, tried to steal £97m with his criminal gang through VAT repayment claims on false exports of clothes and mobile phones.

The 55-year-old also headed the operation to import and sell counterfeit clothes that would have been worth at least £50m if they were genuine.

Patel, from Preston, used the proceeds to buy property across his home city and London through offshore bank accounts.

A key element of the prosecution’s case was when a member of the gang driving a van full of counterfeit clothes was stopped by Scottish police officers on the A74 near Ecclefechan in Dumfries and Galloway in August 2005.

Inside the van were a huge variety of ripped off brands, including Calvin Klein, Walt Disney, Nike, Prada, Emporio Armani, Lacoste and Levi Strauss.

After travelling to Dubai in July 2011 and failing to return, Patel was tried in his absence at Chester Crown Court.

He was found guilty on Tuesday of false accounting, conspiracy to cheat the public revenue, the onward sale of counterfeit clothing and money laundering. He will sentenced next month.

Co-accused Mohamed Jaffar Ali, 58, of Dubai, was also found guilty of conspiracy to cheat the Revenue and money laundering.

After attending the majority of the trial, he failed to attend court on March 27 and a warrant was issued for his arrest. He will also be sentenced next month.

HMRC

HMRCThe convictions follow a 14-week trial at Chester Crown Court.

It comes after a joint investigation between HM Revenue and Customs (HMRC) and Lancashire Police.

As a result of the action, a total of 24 members of the criminal empire were convicted in five trials between 2011 and 2014 and jailed for a combined total of over 116 years.

More than £78m of the gang’s UK assets have also been restrained by HMRC and proceedings are now underway to recover these funds for the public purse.

Richard Las, director of the Fraud Investigation Service at HMRC, branded the investigation “one of the biggest tax fraud cases ever investigated”.

He said: “For more than a decade HMRC and our partners have worked tirelessly and together to bring this gang to justice.

“Arif Patel lived a lavish lifestyle at the expense of the law-abiding majority. Tax crime is not victimless and fraudsters like this pair steal the money that funds the NHS and other vital public services we all rely on.”

Sam Mackenzie, assistant chief constable at Lancashire Constabulary, said: “While presenting himself as a genuine and reputable businessman Arif Patel in fact used stolen taxpayers’ cash to line his own pockets and fund a lavish lifestyle.

“This is money that should have been used to fund the vital public services which we all rely on and to which most of us contribute our fair share by working hard and paying tax.

“I welcome these guilty verdicts which are the culmination of a lengthy and complex investigation which has involved many years of hard work and dedication by police officers and staff and partners from HMRC who have worked together in a truly joint operation.”

Andrew Fox, senior prosecutor of the Crown Prosecution Service, added: “The convictions of Arif Patel and Mohamed Jaffar Ali successfully conclude this part of an immense investigative and prosecution case against an organised criminal group.

“The cost to the public purse was tens of millions, money that could have been used for essential public services in the NHS, social care and education.

“Patel was convicted in his absence, having remained in Dubai throughout the trial.

“The CPS will now pursue confiscation proceedings against the defendants, to prevent them enjoying the benefits of their criminal enterprise.”

Patel, through his Preston-based company Faisaltex Ltd, turned to bulk imports of counterfeit clothing in 2004.

As well as being involved in the overall criminal operation, Jaffar Ali also laundered the proceeds through bank accounts he set up in Dubai and offshore.

Over the next three years, dozens of containers with fake designer clothing inside were stopped at ports across the UK, including Liverpool, Southampton and Felixstowe.

The distribution to traders around the UK was confirmed after a delivery to a Glasgow wholesaler was intercepted by police and discovered to be poorly made designer rip-offs.

From 2004, Patel also used the business to make fraudulent VAT repayment claims on the supposed high-value goods and yarns.

The gang made a total of £97m in fraudulent claims for the false export of textiles and mobile phones, however HMRC stopped £64m of the claims.

HMRC

HMRCThe type of scam is known as a carousel fraud in which goods are purportedly sold to genuine buyers but the whole process is in fact controlled by the criminal who instigates a paper trial of alleged sales and exports in order to reclaim VAT.

Investigators found that Patel frequently travelled to Dubai to meet Jaffar Ali and also made trips to China and Turkey to set up deals with manufacturers of counterfeit clothing.

The profits were laundered by Jaffar Ali through freezone companies and bank accounts held in the UAE.

Money was sent to companies registered in the British Virgin Islands before Patel used it to buy property in his hometown of Preston – including commercial properties on Fishergate, the city’s main shopping street.

The criminal enterprise was able to operate as a result of the help of dozens of lieutenants around the UK, including professional enablers.

Those guilty of involvement include two chartered accountants from a Preston-based practice: Anil Hindocha, 69, from Preston, and Yogesh Patel, 66, from Aylesbury.

Hindocha was jailed for 12 years and 10 months in 2014 after being found guilty of false accounting, conspiracy to cheat the public Revenue and money laundering.

Yogesh Patel was jailed for five years and seven months after being found guilty of conspiracy to cheat the public Revenue and money laundering.

Arif Patel’s brothers Munaf Umarji Patel and Faisal Patel are on Lancashire Police’s wanted list.

Anyone with information about their whereabouts should phone 101, call Crimestoppers anonymously on 0800 555 111 or email contactmanagementfcr@lancashire.pnn.police.uk.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

HMRC

HMRC