Clients of a Glasgow-based law firm say they have been left thousands of pounds out of pocket after it suddenly closed earlier this month.

Brunton Miller Solicitors started operating shortly after World War I, after two firms, established in the 1880s, amalgamated.

The business specialised in a number of different fields, including conveyancing, family and estate law.

People who used their services have told STV News they are owed thousands and cases have been left unresolved.

Have you been impacted by Brunton Miller’s closure?

Tell us your story.

In a statement on November 3, the Law Society of Scotland confirmed that the firm had ceased to practise and its head of interventions, Fiona Watson, had been appointed judicial factor by the Court of Session.

A judicial factor can be appointed if it has been found that a firm’s accounting records have not been kept properly. Rarely, it may be suspected that client money is missing.

Work is being carried out at both offices to secure client files and funds, the Law Society said. The operation has been described as “substantial” with a focus on “urgent matters”.

The Law Society stated that it has been contacted by a “large number” of clients, indicating that hundreds of people are affected.

‘I’m still waiting for my £9,500 back’

Walter Johnston, a property developer and commercial landlord, had used Brunton Miller for almost two decades to help with both personal and business legal work.

His last bill saw him charged £9,500 as part of a civil case he was pursuing against a business.

However, Accountancy in Bankruptcy (AiB), Scotland’s insolvency service, deemed the bill to be far too high.

A revised bill of £2,810 was agreed upon and was subsequently settled by the business Mr Johnston was taking action against.

Mr Johnston believes Brunton Miller was paid twice for the same work and owes him the £9,500 he paid.

The money was retained by the solicitors despite them having overcharged him. He threatened to complain to the Law Society just before the judicial factor closed the firm.

He has still yet to be refunded his £9,500.

Mr Johnston told STV News: “After £2,810 was charged to the trustee and the money was sent to Brunton Miller, the firm didn’t tell me about this outcome.

“When I brought it up to the solicitor he offered to give me £2,810 back but I wanted £5,500 because the AiB said I had been overcharged.

“I have still not received any of the money back.”

‘I’ve been left in the dark’

Brunton Miller assisted Alistair Greer with his mother’s estate following her death in 2010. However, 15 years later, the estate is yet to be concluded.

Eight years after Mr Greer’s mum died, a solicitor alerted him to shares held in Shell and technology company Equinity totalling around £8,000 – this amount was taxed at 40%.

It took four years for the shares to be sold off; however, between 2010 and 2022, they accumulated unpaid interest on the tax owed.

“I feel really angry with the way they have treated me over the last 15 years”

In October this year, Mr Greer discovered that the solicitor no longer worked for the firm after three weeks of making phone calls.

An appointment was arranged to discuss the estate.

Brunton Miller offered to pay for the interest built up between 2018 and 2022 due to the fact “that matters were not dealt with in the way they should have”, according to an email sent by a firm employee.

Last month, Mr Greer paid his share of the interest, totalling £737.68, to the Glasgow-based law firm. He was under the impression that this would be paid to HMRC, along with Brunton Miller’s portion, worth around £1,200.

The firm has since closed with immediate effect, and he is unsure if the matter has been concluded.

Mr Greer told STV News: “I feel really angry with the way they have treated me over the last 15 years.

“It got to a point where I was considering complaining to the law society about their treatment of me before they shut their doors.

“I’ve been left in the dark after it shut down.”

Law firm partner’s restricted certificate

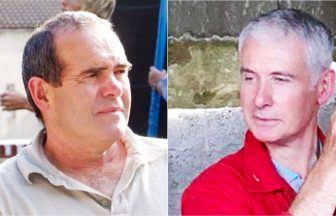

Both clients said they had dealt with Tom Steel, who had been working with the firm since 1986 and was listed as a director on Companies House until September of this year.

In December 2023, he was found guilty of professional misconduct after he failed to wind up a deceased person’s estate, which had remained open since 2011.

A restriction was placed on his practising certificate for three years, which limited him to acting as a qualified assistant under the supervision of an approved employer.

According to the Law Society, managers, such as directors or partners, of firms must have an unrestricted practising certificate.

Have you been impacted by Brunton Miller’s closure?

Tell us your story.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock