Inverness have staved off the immediate threat of administration and paved the way for investment into the club after directors agreed to convert loans into equity.

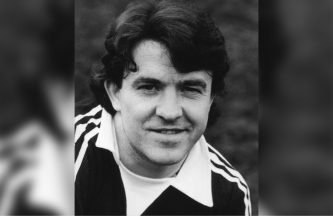

The development comes a week after former chairman Alan Savage was handed control of the club’s finances in a bid to turn around their fortunes.

It is understood Savage himself put a significant sum of money in last week to ensure Saturday’s League 1 encounter with Montrose could go ahead, and enable the club to receive delivery of their new strips among other issues.

Talks with directors on Monday morning have now cleared a major amount of debt from the books, a situation which could lead to much-needed investment in the club.

A club statement read: “Alan Savage today met with Inverness’ board of directors and other key stakeholders for crunch talks as the club takes crucial steps toward dealing with its financial issues.

“Following lengthy discussions, the club successfully reached an agreement with stakeholders, including Ross Morrison and David Cameron who have long been critical financial supporters of the club, to change loans to the club to equity in a move that will be a massive step towards securing the club’s financial position.”

Savage added: “I am delighted by the outcome of today’s talks, this is a huge first step towards securing the club’s future.

“The decisive action taken by the board and stakeholders will enable us to put the club back onto a firm financial footing and I applaud the support they have shown to the club in this moment of need.”

Caley Thistle faced a critical situation last week and brought in Savage, who led the club’s board between 2006 and 2008. He is the founder and chairman of Inverness-based engineering recruitment firm Orion Group.

Scot Gardiner immediately left his role as chief executive of the Highland club, whose financial position deteriorated further after they were relegated from the William Hill Championship in May.

The move spelled the end of a proposed takeover led by English-based Seventy7 Ventures, a company founded by Ketan Makwana which had an offer accepted late last month. It is understood that deal was shelved amid uncertainty over funds.

The club’s debts included loan fees which were due to Dundee, Ross County and Livingston. That situation has been addressed and Monday’s deal will also see fresh money coming in from directors next week.

Crucially, it will also pave the way for talks with Portuguese investors and potentially others who had expressed interest in purchasing a stake.

The club are working with Scottish sports marketing agency GRM Marketing to engage with a number of investment leads.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News