The build-up to Rachel Reeves’ Budget was marred by weeks of confusion and speculation.

Then the Office for Budget Responsibility published its growth forecast in error ahead of the chancellor’s statement to the House of Commons on Wednesday – a move that goes against tradition.

Reeves described that blunder as “deeply disappointing”.

But all that aside, what did the Budget actually contain and what does it mean for millions of people across the country?

STV News breaks down the key announcements and examines the implications for people living in Scotland.

What is happening to tax thresholds?

iStock

iStockIncome tax thresholds are decided at Holyrood, except for the personal allowance.

We won’t know until the Scottish Budget in January if there are any forthcoming changes to rates and bands in Scotland.

But Reeves announced on Wednesday that income tax and National Insurance thresholds will be frozen until April 2031, meaning more people will pay higher rates as salaries rise.

Lucy Logan, DipPFS BSc (Hons) at Calderwood Financial, told STV News: “Income tax is devolved in Scotland, but the Scottish Government could potentially follow suit in January.

“Freezing thresholds means more people are pulled into higher tax bands, as wages rise with inflation. This is effectively a stealth tax, increasing the burden on working households year after year.

“Employers face challenges too. Adjustments to pension salary sacrifice rules mean many Scottish companies will cap contributions. Without such limits, employers risk uncontrolled National Insurance liabilities.

“For small firms and professional services, these measures could force cutbacks in benefits or investment, just when growth and resilience are most needed.”

Extending the freeze on the personal allowance means that as salaries rise over time, more people reach an income level at which they start paying tax.

The freeze in tax thresholds will result in 780,000 more basic-rate, 920,000 more higher-rate, and 4,000 more additional-rate income tax payers in 2029/30, raking in about £8bn for the Exchequer.

The thresholds were frozen in 2021 when Rishi Sunak was chancellor, and were due to end in 2028. The extension of the freeze for another two years until 2030 is expected to raise the Treasury £7.5bn a year.

Other personal tax changes include £4.7bn through charging national insurance on salary-sacrificed pension contributions, and £2.1bn through increasing tax rates on dividends, property and savings income by two percentage points.

Will the economy grow in the coming years?

The Office for Budget Responsibility (OBR) forecast gross domestic product (GDP) would grow by 1.5% this year, an increase from its earlier 1% forecast.

But it downgraded growth in 2026 from 1.9% to 1.4%, in 2027 from 1.8% to 1.5%, in 2028 from 1.7% to 1.5% and in 2029 from 1.8% to 1.5%.

Reeves said “borrowing will fall as a share of GDP in every year of this forecast” and the amount of headroom against the UK Government’s targets will double to £21.7bn, “meeting our stability rule and meeting it a year early”.

Two-child benefit cap

iStock

iStockReeves said the two-child benefit cap will be scrapped from April, at an estimated cost of £3bn by 2029-30.

The move frees up £155m in Scottish Government cash already allocated to mitigate the cap ahead of setting its own budget in January.

First Minister John Swinney has previously said the money would be invested in other initiatives in an effort to bring down the rate of child poverty.

Reeves said: “We on this side of the House do not believe that the solution to a broken welfare system is to punish the most vulnerable children.”

More than 1.5 million children are currently living in households affected by the two-child limit, which is around one in nine children in the UK.

It is estimated that scrapping the cap could lift 350,000 children out of poverty and reduce the depth of poverty for a further 800,000 children.

What other measures were there for Scotland?

iStock

iStockMPs were told £820m will be allocated to Scotland through the Barnett Formula. Northern Ireland will receive £370m, while Wales will get £505m.

Scotland’s funding from the UK Treasury – known as the block grant – is adjusted to reflect spending on devolved areas like health and education in England.

The calculation takes into account Scotland’s population alongside other key factors. Where things get most complex is welfare, with responsibilities split between Westminster and Holyrood.

Low-carbon technologies in Grangemouth, where an oil refinery closed earlier this year, will receive £14m backing, while there was also money announced for Inverclyde and Fife.

The chancellor told the Commons: “In Scotland, I’m committing over £14m for low-carbon technologies in Grangemouth, £20m to renew infrastructure at Inchgreen in Inverclyde, and £20m to redevelop Kirkcaldy town centre and seafront, with construction starting next year.

Pensions and savings

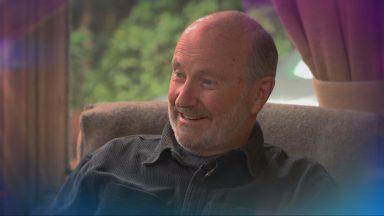

STV News

STV NewsNational Insurance will be charged on salary-sacrificed pension contributions above an annual £2,000 threshold from April 2029, according to the OBR.

Salary sacrifice enables people to maintain their take-home pay, as people end up paying lower national insurance (NI) contributions.

There are also NI advantages for employers, helping them to offer more generous workplace benefits.

Meanwhile, the annual cash ISA limit will be reduced to £12,000. The aim of reducing the limit from £20,000 is to encourage more people to invest their money in stocks and shares instead.

Fuel duty

iStock

iStockReeves said the 5p per litre cut in duty introduced by the Conservative government in March 2022 would only be extended until September 2026.

It would be “reversed through a staggered approach”, the OBR said.

From April 2027, the UK Government has stated that fuel duty rates will be increased annually by the RPI measure of inflation, the document said.

Fuel duty has not risen since April 2010. Before the introduction of the 5p per litre cut, fuel duty had been frozen at 57.95p per litre since March 2011.

VAT is charged at 20% on top of the total price.

Gambling

MPs were told the tax on remote gaming will rise from 21% to 40%, and on online betting from 15% to 25%, while there are no changes for in-person gambling or horse racing.

She will also abolish bingo duty in April 2026

Electric vehicles

iStock

iStockThe chancellor announced a new electric vehicle excise duty.

She said this will enable the government to double road maintenance funding in England, and offer a further £200m for a rollout of electric vehicle charging points.

Drivers of battery electric cars will be hit by a 3p per mile tax from April 2028, with the charge to rise annually with inflation, according to the OBR.

The Treasury faces a reduction in revenue from fuel duty, which raised just under £25bn in the 2024/25 financial year, as more drivers move from petrol or diesel cars to EVs.

Dr Mengfei Jiang, lecturer in finance at the University of Edinburgh, said: “The combination of higher EV subsidies and a potential per-mile road tax shows the government trying to balance two aims: encouraging the switch to electric vehicles while addressing the loss of fuel-duty revenues.

“The key question is whether the extra grant funding will actually lead to additional EV purchases. The environmental externalities, such as cleaner air and lower lifecycle emissions, only materialise if the funding persuades new buyers to switch, rather than subsidising decisions people would have made anyway.”

Milkshake tax

Getty Images

Getty ImagesA sugar tax on pre-packaged milkshakes and lattes has been announced, ending an exemption for milk-based drinks from the existing tax.

The threshold for the tax will also be reduced to 4.5 grams of sugar per 100ml. The move will affect packaged milkshakes and coffees, but not drinks made in cafes and restaurants.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country