MSPs have voted to back the Scottish Government’s plans to create a new tax bracket for higher earners.

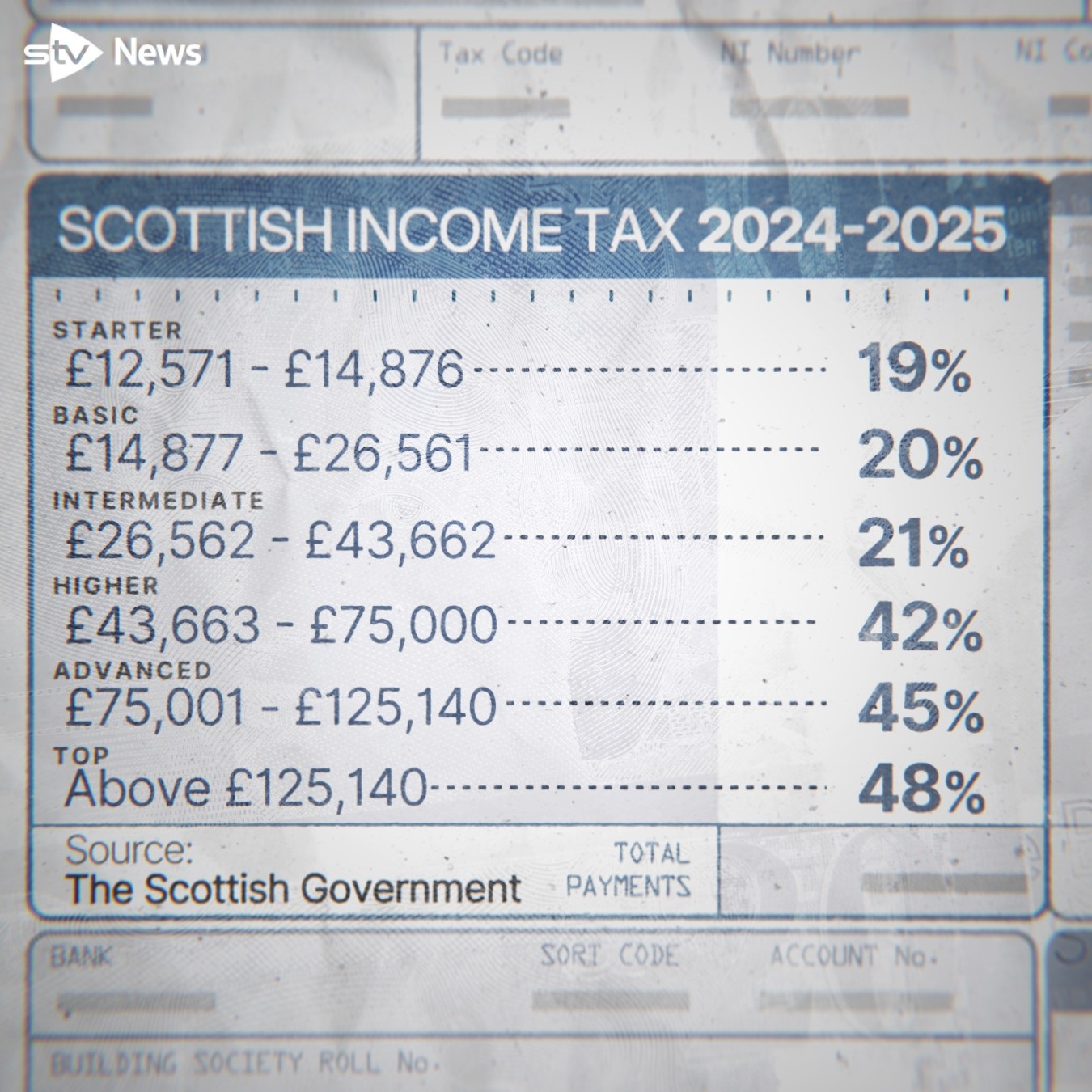

A new rate will be implemented for those earning between £75,000 and £125,140.

The new 45p-in-the-pound rate will sit alongside a 1% increase to the highest tax band, which will take it to 48% – with both changes impacting the top 5% of Scottish taxpayers.

These two decisions should raise around £82m, according to the Scottish Government.

It means Scotland will have six tax bands while England has three.

What does the budget mean for you?

STV News

STV News- Anyone earning more than £75,000 will pay more in tax

- The 42% income tax threshold for earnings above £43,663 won’t rise with inflation

- This means that more middle earners will pay the higher rate

- People earning below £43,000 should not pay any more in tax

The Scottish Fiscal Commission (SFC) forecasts the tax changes will bring in £1.5bn in revenue funding next year alone, although its chair said “tough decisions” are still likely to be necessary in individual Government departments.

The stage three debate on the Scottish Government’s budget for the next year will take place next week. Other policies include:

- All Scottish benefits will rise with inflation

- Scottish Child Payments will rise to £26.70 from April next year

- School meal debt for children will be wiped as ministers provide councils with a £1.5m fund

- Business rates for premises valued at less than £51,000 will be frozen while island hospitality businesses will be given 100% relief

Humza Yousaf offered councils the equivalent funding of a 5% council tax rise if the froze rates – in the hope of having a council tax freeze across Scotland.

But on Thursday, Argyll and Bute Council became the first local authority to reject the offer and announced a 10% hike.

How does Scotland differ from the rest of the UK?

The move to tax higher earners more has been criticised by Prime Minister Rishi Sunak as “disappointing”.

Scotland is already the highest taxed part of the UK, with those earning more than £50,000 paying around £1,500 more a year than those in other parts of Britain before Tuesday’s budget.

The deputy FM said it was fair that those with the broadest shoulders pay more as the Scottish Government tries to avoid cutting public services.

People with earnings over £28,850 in Scotland, slightly above median earnings, pay more income tax than they would in the UK, according to the Scottish Fiscal Commission.

The latest policy decisions widen the gap further for those earning over £75,000 (the top 5% of taxpayers).

Scottish Government changes to income tax policy since 2017 mean someone in Scotland earning £100,000 will now pay £3,346 more in income tax than they would in the rest of the UK.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country