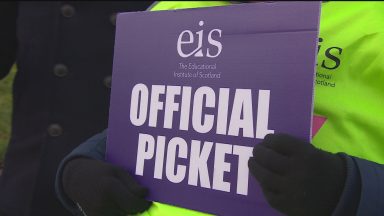

Treasury ministers are being urged to act on a “scandalous detriment” which union leaders claim has led to thousands of teachers being overtaxed, costing them tens of millions of pounds in total.

Andrea Bradley, general secretary of the EIS teaching union, has written to the Exchequer Secretary to the Treasury, James Murray, demanding he order councils to repay the overpaid tax.

The union says teachers in 16 local authority areas – half of all Scottish councils – were incorrectly taxed at the Scottish higher rate of 42% on backpay they received after strike action led to a 14% pay rise over two years.

As part of the deal, teachers were awarded a 7% pay rise for 2022-23 which was backdated to April 2022.

But the union said that after the “protracted” dispute, “thousands” of teachers did not get the backpay they were due until after the start of the next financial year in April 2023.

In the letter to Murray, Bradley said: “The backpay paid in the tax year 2023-24 fell to be taxed at the Scottish higher rate of 42%, rather than typically being taxed at 21% if it had been paid in the preceding year, as it was for teachers in Scotland’s other 16 local authorities.”

A spokesperson for local government body Cosla said it had made clear to the EIS and other teaching unions involved in the dispute that if a pay deal was agreed after the cut-off dates for March payments, the “backpay would be taxed in the tax year 2023-24”.

But Bradley said: “Thousands of EIS members, across 16 local authorities, have suffered significant financial disadvantage as a result of the delay in receiving backpay through no fault of their own.

“Since first being made aware of the issue in April 2023, the EIS has repeatedly attempted to seek a resolution.”

Claiming the EIS believes the total amount overpaid by teachers “runs to tens of millions of pounds”, Bradley added that neither the councils involved or HM Revenue and Customs (HMRC) “seem willing to rectify what are scandalous detriments to thousands of Scottish teachers”.

She urged Murray to “raise this matter with the relevant HMRC colleagues as an important next step towards the realisation of pay justice for the tens of thousands of Scottish teachers who continue to suffer this detriment”.

Bradley insisted HMRC, Cosla and the 16 councils “ought no longer to avoid doing what is right”.

A Cosla spokesperson said: “Taxation of pay and the regulations that govern it are set by HMRC at a UK-wide level.

“The teaching unions were informed by Cosla during pay negotiations in early 2023 that if the negotiation was concluded after the pay cut-off dates for making a payment in March 2023, backpay would be taxed in the tax year 2023-24.

“Nonetheless the unions chose to prolong the negotiations in the hope of obtaining a better pay settlement, which they indeed secured.

“Payment of wages and taxation are local matters for individual Scottish councils as separate employers.

“Each of our member councils has its own unique payroll systems. Following the agreement of the 2022-2024 pay settlement on March 15 2023, some councils were unable to pay the uplift or backpay before the end of the tax year. Councils did not benefit financially by doing this – taxation goes directly to national Government.

“We understand from briefings by the affected councils that taxation of pay was handled correctly and in line with HMRC guidance.”

HMRC has been contacted for comment.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock