Key Points

-

Scottish hospitality leaders are calling on the UK Government to cut VAT to help struggling businesses survive.

Scottish hospitality leaders are calling on the UK Government to cut VAT to help struggling businesses survive. -

The industry says it has been left “bruised and battered” by the pandemic, rising costs and national insurance hikes.

The industry says it has been left “bruised and battered” by the pandemic, rising costs and national insurance hikes. -

Hospitality figures argue the UK’s 20% VAT rate is unsustainable compared with much lower levels across Europe.

Hospitality figures argue the UK’s 20% VAT rate is unsustainable compared with much lower levels across Europe. -

Business owners warn that without a VAT reduction, more jobs and venues will be lost across Scotland.

Business owners warn that without a VAT reduction, more jobs and venues will be lost across Scotland. -

The UK Government says it is already supporting the sector through measures such as alcohol duty cuts and licensing reforms.

The UK Government says it is already supporting the sector through measures such as alcohol duty cuts and licensing reforms.

Scottish hospitality leaders have urged the UK Government to cut VAT to prevent the beleaguered sector from plunging further into crisis.

Businesses say they have been left “bruised and battered” after the coronavirus pandemic, the cost of living crisis, rising fuel bills and national insurance hikes.

The Scottish Hospitality Group says the industry lost thousands of jobs in August and is calling for urgent action to help struggling businesses.

One such measure would be to reduce the rate of VAT for food sales by hospitality businesses to bring the UK in line with countries such as Germany, France, Spain and Italy.

‘Every day is a new challenge’

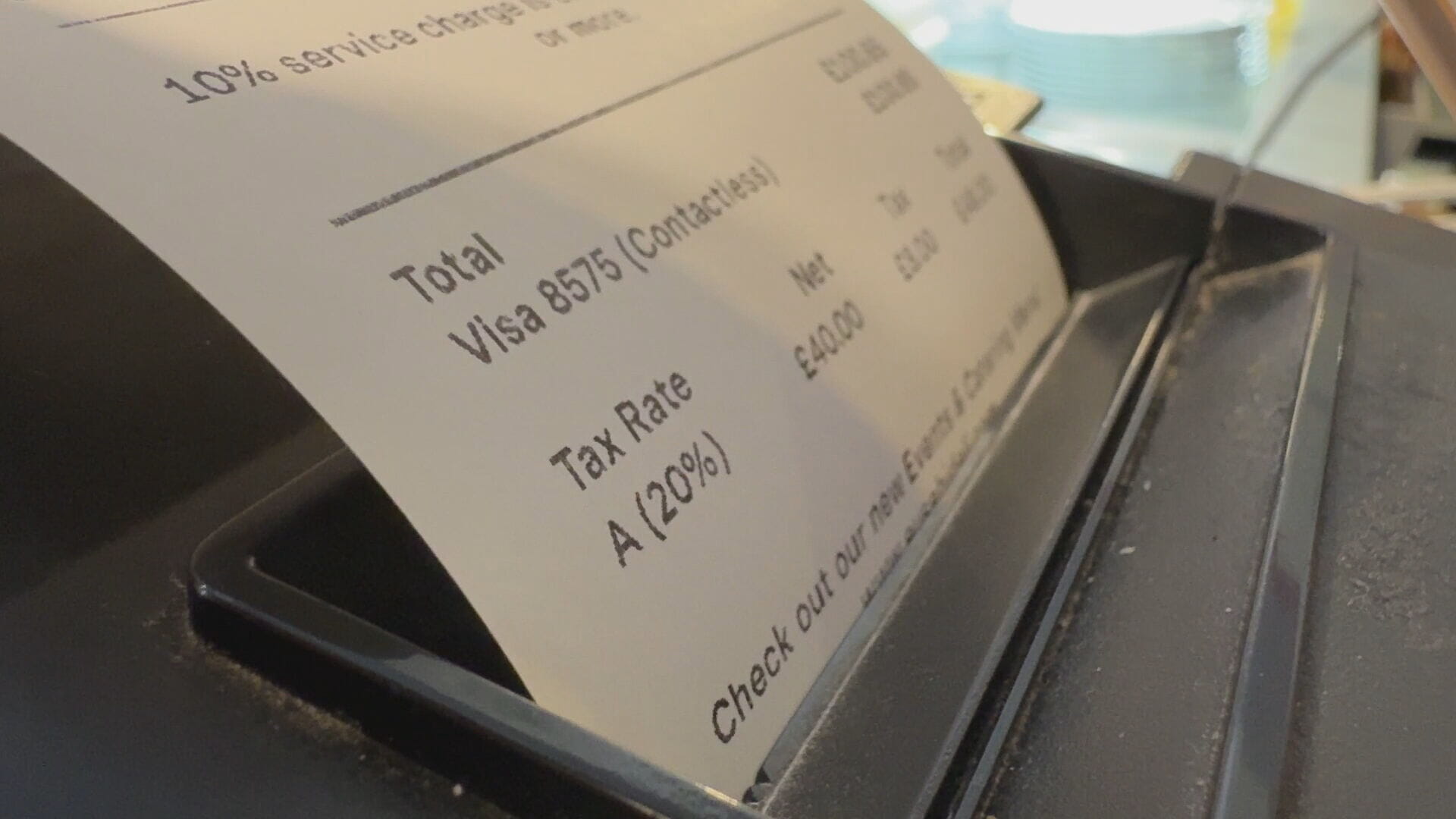

Restaurants, bars and hotels currently face a 20% VAT charge on every bill. Industry figures argue the rate is unsustainable compared with other European countries.

In Glasgow’s west end, Eusebi Deli is a popular Italian restaurant and takeaway. But it’s not immune to the current economic pressures despite its loyal following.

“As busy as we are, every day is a new challenge,” said Michael Prior, the general manager at Eusebi Deli.

STV News

STV News“The national insurance increase on top of VAT at 20%, alongside all the other costs that are rising, is making it very difficult,” one business owner said.

The UK rate is twice as high as eating out in France, Italy and Spain, and more than double the level in Ireland, Germany and Sweden. Research shows Germany’s cut to 7% VAT generated almost 50,000 new hospitality jobs.

Stephen Montgomery, director of the Scottish Hospitality Group, said: “We are already getting pounded by tax and VAT, then Rachel Reeves hit us with an extra employers’ national insurance, hospitality jobs down 25%, and it’s getting worse.

STV News

STV News“I think it’s time now for Reeves and the UK Government to pin back their ears and actually listen to the industry and say, ‘we need to sort this now.’

“VAT’s a killer. If you look at where European countries are compared to the UK, we have the highest VAT in Europe.

“It’s just become one of the unaffordable taxes on the hospitality sector, and it needs to change. We’ve got food inflation going up, utility bills are off the scale, so it’s a perfect storm.”

‘The golden goose’

The UK Government reduced VAT during the coronavirus pandemic, and business owners are demanding a repeat of that intervention.

Louise MacLean, director of sales at Signature Group, said: “It is baffling, we seem to be the golden goose.

STV News

STV News“There’s no help coming, we’re on our own, we’ve got to try and navigate these incredibly choppy waters by ourselves, and there is no exaggeration in how hard it is to operate in hospitality right now.

“A VAT reduction for the hospitality sector would be a much-needed lifeline. We’re such an overly taxed industry.”

Warning of job losses

Signature Group operates a wide range of popular venues, including Cold Town House in Edinburgh, Church on the Hill in Glasgow and The Spiritualist in Aberdeen.

But Maclean warns that without action, margins will be squeezed further, prices will rise, and closures could follow.

“Without a VAT reduction, customers are going to feel it at the till,” said Maclean.

STV News

STV News“That has to happen because otherwise we’re going to be loss-making businesses, there’s going to be fewer of us around.

“We’ve lost 89,000 jobs in hospitality already this year, and there is no sign of that stopping. How do we fund expansion when there is no profit to pay for the expansion?”

With the autumn budget approaching, the sector says the Chancellor must deliver support or risk leaving businesses with a bitter taste.

A spokesperson for the UK Government said: “Pubs, cafes and restaurants are vital to local communities, that’s why we’re cutting the cost of licensing, helping more pubs, cafes and restaurants offer pavement drinks and al fresco dining.

“This is on top of cutting alcohol duty on draught pints, capping corporation tax and providing a record £50.9bn settlement for Scotland.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country