Scottish business owners and workers say they are still financially and mentally “crippled” almost six years after they were excluded from the UK Government’s monetary support schemes during Covid.

In March 2020, the entire country came to a standstill after the then-prime minister Boris Johnson announced a nationwide lockdown to slow the spread of Coronavirus.

As part of the measures, all non-essential industries, such as hospitality, hotels and personal care services, were forced to close their doors.

To mitigate the financial impact, former chancellor Rishi Sunak announced a range of schemes, including furlough, grants, and self-employed income support, to ease the strain on workers and business owners.

The Scottish Government also provided more than £4.7bn of business support funding during the pandemic, including a variety of grants and a furlough top-up scheme.

However, according to non-profit organisation ExcludedUK, which was launched in May 2020, around 3.8 million taxpayers were left to fend for themselves.

From new starters, those in between jobs or due to start new jobs after March 19, 2020, those denied furlough, the newly self-employed and new businesses, those earning less than 50% of their income from self-employment, over £50,000 of trading profits, those on maternity, parental or adoption leave, those on PAYE freelance short-term contracts, small limited company owner-directors and businesses they were all ineligible for financial support.

ExcludedUK say they know of at least 40 people who have taken their own lives due to the effects of missing out on financial support during the pandemic.

STV News has spoken to three people living in Scotland who believe they were wrongfully excluded from vital financial support.

‘I’m still being crippled by it; we’ve still not financially recovered’

Chris Scott was a full-time photographer covering weddings and other events. As business demand continued to grow, he invested more than £80,000 in renovating a studio of his own in Dundee.

The 55-year-old was on course to have his best year ever as a business when Covid lockdowns were implemented.

He received an initial £10,000 grant from the council; however, Chris was left with £2,000 after he refunded a number of brides who cancelled their weddings due to the pandemic

The photographer applied for the self-employed income support scheme via the HMRC website but was told he was not eligible because his profit margins were £136 short due to the renovation two years prior.

Chris believes that if he had bought one chair less for a conference table built at the studio in 2018, he would have been eligible.

The photographer raised his concerns with Keir Starmer when the latter was a guest on LBC in November 2020.

The Labour leader committed to asking the chancellor Rishi Sunak about the more than 3.8 million taxpayers excluded from receiving financial support during Covid.

Starmer said at the time: “This has been absolutely devastating. To fall through the cracks back in March was bad enough, but still not having the support you need is not acceptable.

Supplied

Supplied“So, Chris, I’ll take that away as a result of your phone call and redouble our efforts.”

Starmer brought up Chris’s story at Prime Minister’s questions, urging Boris Johnson to offer support.

The then-PM stated that the best way to combat the virus was to continue with the measures in place and thanked members of the public for their “sacrifice”.

More than five years later, Chris is still suffering the consequences of the “sacrifice” he was forced to make.

Chris explained: “I had to take two bounce back loans worth £26,000 to keep the lights on.

“All the while, business rent and insurance had to be paid along with all the utilities for my home and business. I’m still being crippled by it; we’ve still not financially recovered.

“We have never got back to the levels we were before Covid, so it is absolutely crippling us. I’m potentially looking at closing the business.

“It has had a significant mental impact as well.”

The photographer is hoping that the Prime Minister steps up now he is in power and issues an apology to those affected and to the families of the people who took their lives.

Chris is also asking the UK Government to step in and nullify any bounce-back loans taken out by those excluded, along with a public apology.

The 55-year-old said: “We were told that nobody should be left behind. But we have been left behind.”

‘We as people are still broken’

Nicola Burton runs Kingston Catering Repairs, a business she launched with her partner Robert Jack in 2001.

The company specialises in repairing ovens, microwaves and grills for hospitality businesses throughout Scotland.

A year before the pandemic, the couple invested in upgrading the computer system they used to track bookings and invoices.

When lockdown was announced, all of Kingston Catering Repairs’ customers were told to close; however, according to the HMRC website, the Glasgow-based business was not required to shut down, so they weren’t offered financial support.

Nicola told STV News: “We had gone from being very busy to worrying about having a roof over our heads and thinking how we were going to afford to feed ourselves.

“We were told that the self-employed would be looked after, but not us, because we weren’t mandated to shut.

“We had to wait for someone to call us and ask us to fix something. Even when the hospitality industry reopened, they were worried about their margins, so if they could go without something working, they would.”

Nicola’s mum had to send money of her own to the couple as they “didn’t know how they were going to live”.

Supplied

SuppliedThe business was given a grant of a few thousand pounds by Glasgow City Council but the business owners also took out a bounce back loan of £20,000 to stay afloat.

Eventually, Nicola was placed on Universal Credit. The couple are still paying back the loan.

The 49-year-old explained: “It has been absolutely devastating.

“I wrote an email to the CEO of TSB in an effort to keep hold of our home and told him how we got to this point. My mental health continued to spiral, and it got to a point where I spent days at a time in bed.

“I thought that if this place goes, I go. Both my partner and I were in bits.

“We could have been rendered homeless.”

The business has entered its 25th year of operation, however, Nicola believes it is a “shadow” of what it was.

The co-owner said: “We as people are still broken by it all.

“We had to sacrifice so much just to stay alive.”

‘The injustice of it all was really devastating’

Joanne Newton worked as a freelance education consultant in the Sheffield area prior to the pandemic.

Around 70% of her income came from contracted training and examination services, which were paid via PAYE, and the other 30% was self-employed income.

This meant that when Covid hit, Joanne was left in a black hole of financial support, ineligible for furlough due to contracted work and unable to apply for SEISS because her self-employed work was less than 50% of her total income.

With a net income of £2,500 a month, she had to apply for £380 in Universal Credit to pay her mortgage and bills.

Supplied

SuppliedThe consultant also took out a bounce-back loan of around £6,000, which she eventually paid off three years later.

Joanne told STV News: “The injustice of it all was really devastating.

“I had no one to talk to about what was happening except the people who understood my situation – Excluded UK.

“I couldn’t worry my mother about it, and so-called friends would just say either the government can’t help everyone, or that perhaps I hadn’t paid enough attention to paying the right taxes.

“I always used a chartered accountant to declare all my complex income/invoices and P60s.”

Following the ordeal down south, the freelancer moved to the Moray area of Scotland out of “pure anger” at the way support was handled during the pandemic.

UK Government action

An All-Party Parliamentary Group (APPG) regarding the Gaps in Covid-19 Financial Support was formed around 12 weeks after the first lockdown.

It involved 262 MPs at its peak, but closed in October 2022. The group was relaunched in January 2025, calling for recognition of exclusion as a policy failure, an assessment of ongoing harm, and action to ensure future crisis support is inclusive by default.

On January 15, a Backbench Business Debate in the House of Commons was held and focused on those who suffered due to the lack of financial support during the pandemic.

ExcludedUK

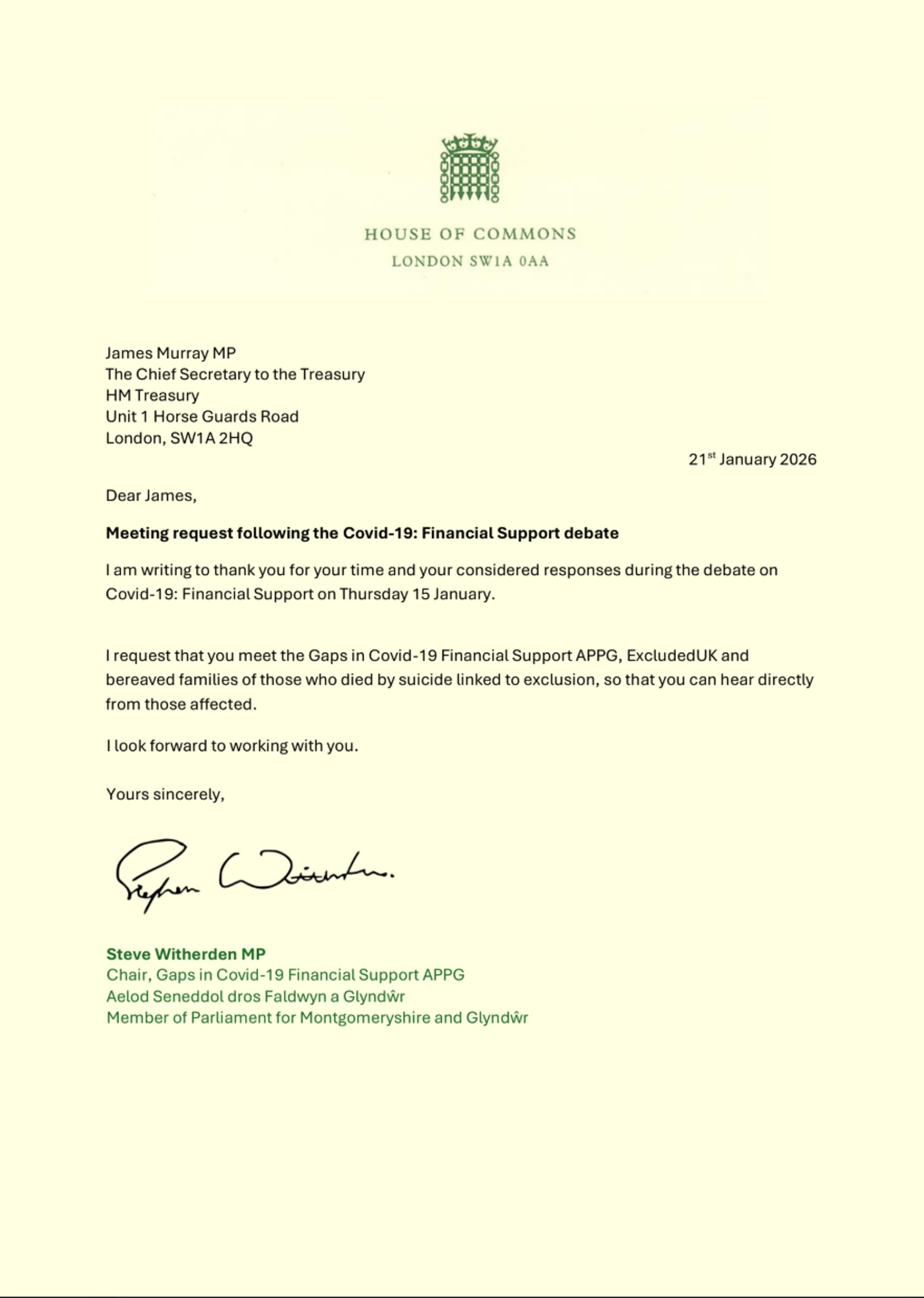

ExcludedUKFollowing the discussion, the group’s chair, Labour MP Steve Witherden, has written to the Chief Secretary to the Treasury, James Murray MP.

He has requested that Murray meet with ExcludedUK and the families of those who have taken their lives due to exclusion from Covid-19 financial support.

The Treasury has confirmed that they “recognise” how painful it was for those who missed out on vital financial support.

A Treasury spokesperson said: “Decisions on eligibility for Covid support schemes were taken by the previous government, who acknowledged that some of the criteria and conditions that were vital to ensuring the schemes worked for the vast majority meant that some people did not qualify.

“We recognise how painful that was for those affected, which is why it is important that their experiences are heard and inform future crisis support, including through published evaluations and the UK Covid‑19 Inquiry.”

The Treasury confirmed that a response to the letter will be issued in due course.

The UK Covid-19 inquiry concluded that the furlough scheme was implemented quickly and successfully.

However, they also found that some self-employed individuals missed out on financial aid because they did not qualify for the support offered.

According to the hearing, some felt they “had slipped through the cracks”.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock