Changes to income tax are being brought in to raise “valuable” revenue for investing in public services, deputy first minister Shona Robison has said.

From Saturday April 6 2024, a new Advanced income tax band will apply a 45% rate on annual income between £75,000 and £125,140.

The new 45p-in-the-pound rate will sit alongside a 1% increase to the highest tax band, which will take it to 48% – with both changes impacting the top 5% of Scottish taxpayers.

The new tax bracket for higher earners was voted in by MSPs in February.

It means Scotland will have six tax bands while England has three.

There are no changes to the Starter, Basic, Intermediate and Higher tax rates for earnings under £75,000.

The Starter and Basic rate bands will increase in line with inflation and the Higher rate threshold will be maintained at £43,662.

STV News

STV NewsThe independent Scottish Fiscal Commission estimates that overall income tax will raise £18.8bn in 2024-25.

Scottish taxpayers are being encouraged to check to ensure the tax code on their first payslip in the new financial year is accurate. People paying Scottish income tax should have a tax code that begins with an S.

Deputy first minister Shona Robison said: “Scotland has the most progressive income tax system in the UK. The new Advanced band builds on that progressive approach, protecting those who earn less and asking those who earn more to contribute more.

“Only 5% of Scottish taxpayers will pay a higher tax rate this year compared to last year and the majority of taxpayers are still paying less than they would elsewhere in the UK.

“The money raised through income tax allows people in Scotland to benefit from a wide range of services and social security payments not provided elsewhere in the UK, including free prescriptions and free higher education. Council tax is less in Scotland than in England, even before factoring in a council tax freeze for 2024-25.

“I encourage everyone to check their first payslip in April to make sure their address is correct and that their tax code starts with an ‘S’. This will ensure that people are paying the right amount of tax on their income.”

The Scottish Fiscal Commission estimates that the cumulative impact of Scottish Government income tax policy decisions since 2017 will raise an additional £1.5bn in 2024-25, compared to the position if UK Government tax policy had been matched during that time.

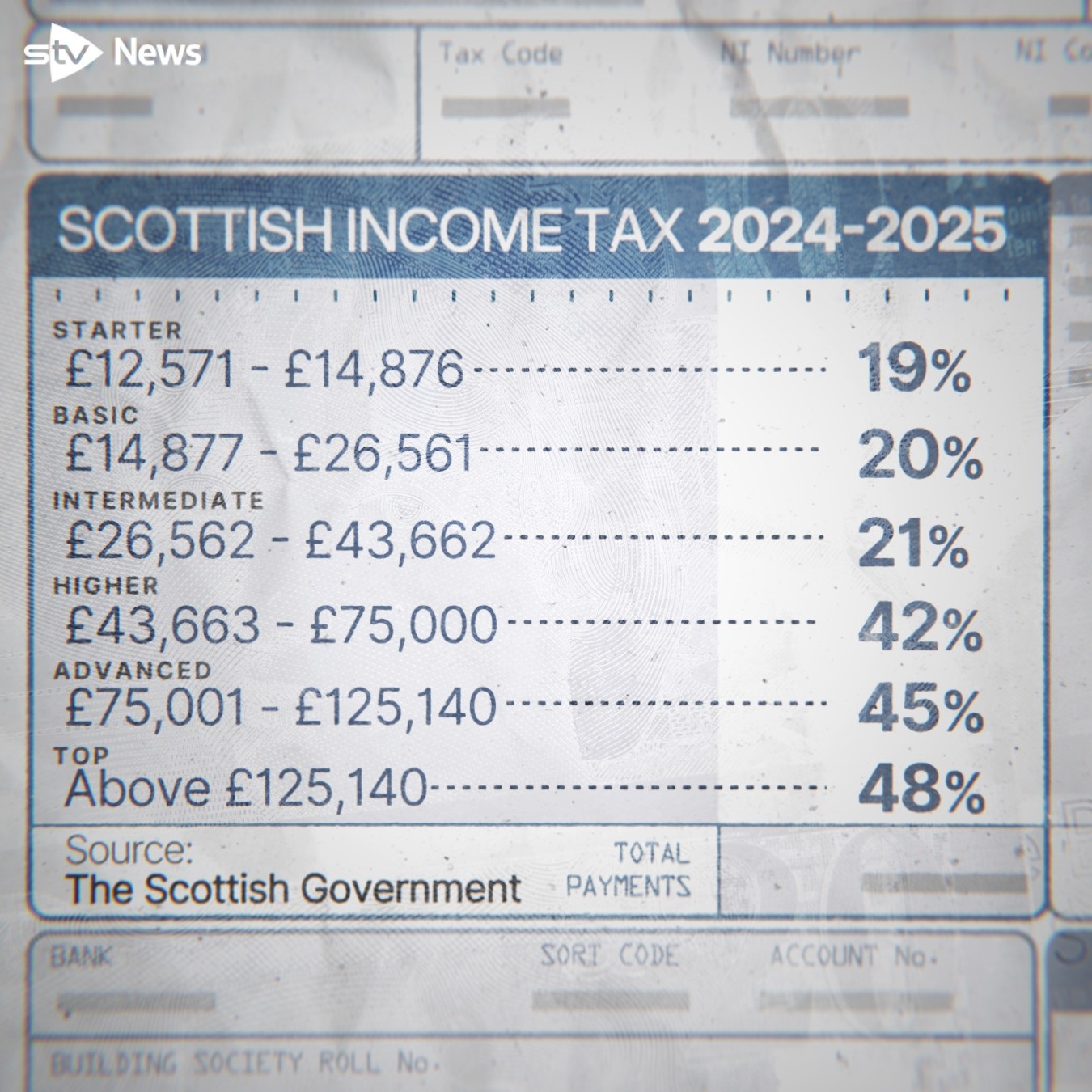

New Scottish income tax bands and rates for financial year 2024-25

Starter band: £12,571 – £14,876

Rate: 19%

Basic band: £14,877 – £26,561

Rate: 20%

Intermediate band: £26,562 – £43,662

Rate: 21%

Higher band: £43,663 – £75,000

Rate: 42%

Advanced band: £75,001 – £125,140*

Rate: 45%

(*under the UK Government’s Personal Allowance policy, those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000)

Top band: Above £125,140

Rate: 48%

Scotland is already the highest taxed part of the UK, with those earning more than £50,000 paying around £1,500 more a year than those in other parts of Britain before February’s budget.

People with earnings over £28,850 in Scotland, slightly above median earnings, pay more income tax than they would in the rest of the UK, according to the Scottish Fiscal Commission.

Government changes to income tax policy since 2017 mean someone in Scotland earning £100,000 will now also pay £3,346 more in income tax than they would in the rest of the UK.

The UK Government confirmed in the 2023 Autumn Statement that the UK-wide Personal Allowance will remain frozen at £12,570.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock