The UK’s highest court has paved the way for a £14bn damages claim to go ahead against Mastercard on behalf of millions of UK consumers.

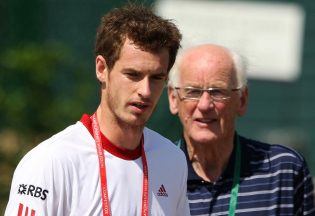

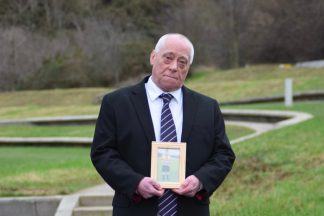

Former financial ombudsman Walter Merricks is trying to bring legal action against the card giant on behalf of an estimated 46.2 million people.

He alleges that Mastercard’s breaches of competition law, found by the European Commission in 2007, have led to UK consumers paying higher prices on purchases from businesses that accepted Mastercard.

Mr Merricks’ proposed class action was thrown out in July 2017 by a specialist tribunal, which ruled the claim was “not suitable to be brought in collective proceedings”.

However, his case was revived by a landmark Court of Appeal ruling in April last year, in which senior judges found that the Competition Appeal Tribunal (CAT) had applied the wrong legal test in deciding whether to give the claim the go-ahead.

Mastercard challenged that ruling at a Supreme Court hearing in May, but its appeal was rejected by a panel of five justices on Friday.

The panel agreed with the Court of Appeal’s conclusion that the CAT’s decision was “undermined by an error of law” and have sent Mr Merricks’ proposed claim back to the CAT to be reconsidered afresh in light of their ruling.

In a statement after the ruling, Mr Merricks said: “I am particularly pleased that the Supreme Court has recognised Parliament’s aim in providing for collective claims where companies have broken competition laws and have caused loss to consumers or small businesses.

“Enforcement of fair competition laws is vital for this country’s market economy and companies who break these laws can now expect not only to be fined by the regulator, but to face much bigger bills in redress claims from those they damaged.”

Boris Bronfentrinker, partner at law firm Quinn Emanuel Urquhart & Sullivan, who represented Mr Merricks, said: “The Supreme Court has recognised the need for mass consumer collective actions to be pursued.

“Mastercard has acted in an anti-competitive manner, that has been definitely determined by the European Court of Justice.

“The Supreme Court has now affirmed the decision of the Court of Appeal that this is a claim that needs to have its day in court to decide the full extent of harm Mastercard has caused to UK consumers.”

He added: “This is a truly historic victory and the focus now moves to securing compensation for the 46 million UK consumers who lost out as a result of Mastercard’s illegal conduct.”

A Mastercard spokeswoman said: “We fundamentally disagree with this claim and know people have received valuable benefits from Mastercard’s payments technology.

“No UK consumers have asked for this claim. It is being driven by ‘hit and hope’ US lawyers, backed by organisations primarily focused on making money for themselves.

“Mastercard will be asking the CAT to avert the serious risk of the new collective action regime going down the wrong path with a case which is fundamentally flawed.”

Rocio Concha, director of policy and advocacy at the Which? consumer rights organisation, which intervened in the Supreme Court case, said: “This is a hugely important win for consumers.

“Which? has campaigned long and hard for an effective collective redress scheme and the Supreme Court’s ruling will increase access to justice for consumers and set the standard for collective claims of this nature to proceed to trial.

“From today, the route to collective redress will be fairer, simpler and more attainable, and many cases that are currently on hold will be able to proceed to trial, ensuring victims of anti-competitive behaviour can get the justice they deserve.”

The proposed claim follows the European Commission’s 2007 decision that Mastercard had breached competition law in relation to the setting of certain fees charged between banks over Mastercard transactions.

Mr Merricks’ claim, which seeks “an aggregate award of damages and interest totalling some £14.098bn”, is one of the first mass consumer claims brought in the UK after the introduction of a class action regime in 2015.

The proposed action is an “opt-out” claim, which means potential claimants – anyone who was over the age of 16 and resident in the UK for at least three months between 1992 and 2008, and who made a purchase from a business that accepted Mastercard – are part of the action unless they specifically choose not to be.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country