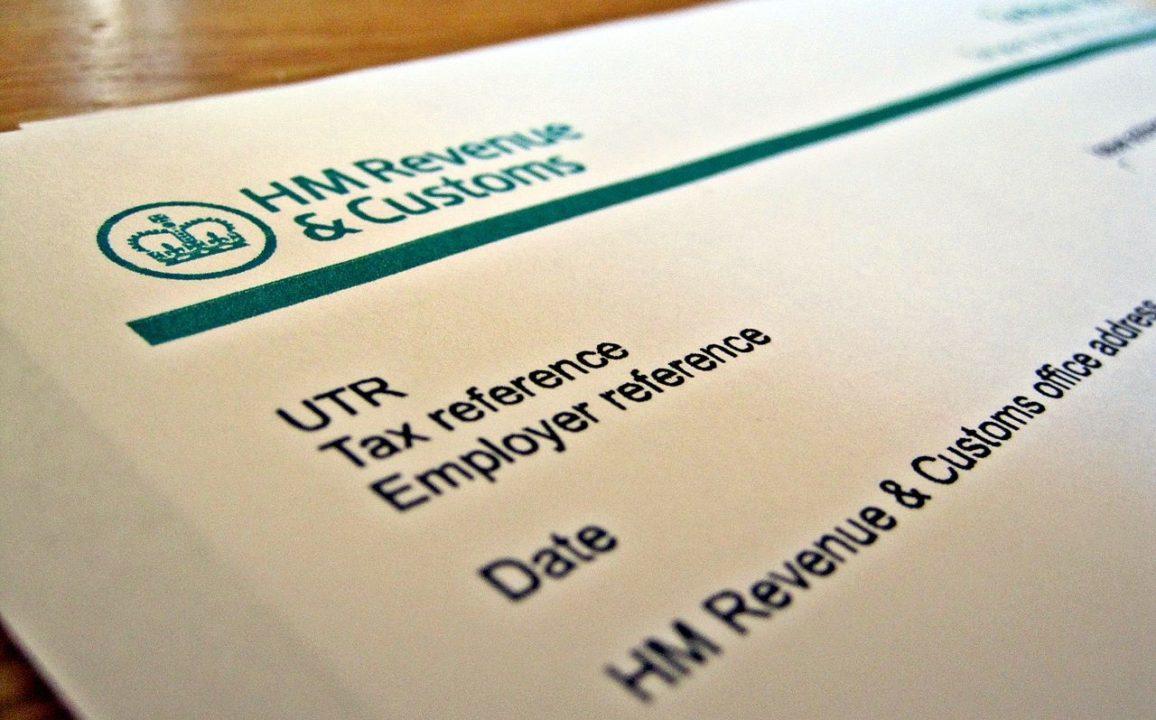

The Scottish Government’s tax changes, which will see higher earners contribute more, have come into effect.

With the beginning of the new financial year, the tax changes laid out in the budget, which ministers claimed would raise an extra £129m in 2023-24, have come to fruition.

Announced by former deputy first minister John Swinney in December and passed by MSPs earlier this year, the changes will see both the higher and top rates of income tax increased by 1p, rising to 42p and 47p respectively.

While the threshold for the 42p tax rate will be frozen, the Scottish Government is proposing all Scots earning £125,140 a year or more will pay the very top rate of income tax.

Deputy first minister Shona Robison said: “The decisions we have made on income tax are fair and progressive by ensuring that those who can, contribute more.

“They strengthen our social contract with the people of Scotland who will continue to enjoy many benefits not available in the rest of the UK such as free prescriptions.

“The additional revenue will help us invest in our vital public services including the NHS, above and beyond the funding received from the UK Government.

“At the same time, the majority of taxpayers in Scotland will still be paying less income tax than if they lived in the rest of the UK.

“Now that the new financial year has started, I’d also encourage people to check that the tax code is correct on the first payslip they get.

“If you think your tax code is wrong, you can check your details with HMRC who will be able to help.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News