Calls have been made for the Scottish Government to make it clear how businesses struggling to survive a looming recession will be supported.

The Scottish Chamber of Commerce’s (SCC) latest findings from its leading business survey highlighted the plight of organisations as they battle increased costs, inflationary pressure, increased pessimism over the global economic outlook, and “misjudged” policies by the UK Government.

In its quarterly economic indicator survey, the SCC surveyed 280 firms and found that a record high of 92% were concerned about inflation.

The main cost concern for businesses is from energy bills, with 80% of firms citing the issue as a top concern, followed by 72% naming labour costs, and 63% highlighting fuel costs.

The survey found a record number of respondents indicated the price of goods could increase in the next quarter.

Some eight in ten firms said they intended to charge consumers more, compared to 50% from the same period in 2021.

All firms reported a fall in confidence compared to the previous quarter and a more significant decline compared to the previous year.

The SCC has urged the UK Government to set a clear, long-term, economic prospectus to provide a stable environment for investment amid rising inflation.

It has also recommended a cut to non-domestic rates from the Scottish Government to ease cost burdens on firms.

Chancellor Jeremy Hunt has been urged to engage with businesses to provide clarity on the proposed targeted support for energy bills beyond April amid fears the policy could be rolled back.

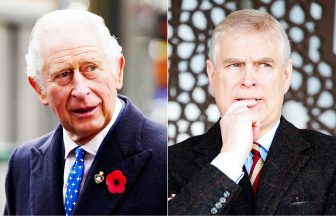

Stephen Leckie, SCC president, said: “Frozen investment, faltering confidence, falling cash flow and profits, and a pessimistic global outlook, paint a concerning picture for businesses in Scotland.

“There is more pressure to come in the winter months. The signs of economic bounce-back don’t look promising as more and more firms are telling us that they have been forced to cancel contracts, projects or plans to expand, due to soaring costs and difficulty in hiring people.

“Whilst we recognise the strain that has been placed on public finances, Governments in Edinburgh and London must make clear how businesses will be supported to survive through the difficult months ahead and what measures will be put in place to support long-term growth.”

A Treasury spokesperson said: “As the chancellor has made clear, a central responsibility of any government is do what is needed for economic stability and sustainable public finances – the bedrock of a growing economy.

“We recognise the challenges businesses are facing in the months ahead, which is why we are helping with their costs through the Energy Bill Support Scheme and a £2.4bn fuel duty cut, and small businesses will be fully protected from next year’s rise in corporation tax.

“We also provided the Scottish Government with a record £41bn for the next three years at the recent spending review.”

A Scottish Government spokesperson said: “We recognise the enormous pressures facing businesses during the current crisis and have been engaging, directly and through key business organisations, to best understand their needs and will continue to do so.

“The Scottish Government is doing everything within its resources and powers to help those most affected and have committed to an Emergency Budget Review to assess all opportunities to redirect additional resources to those most in need, reduce the burdens on business, and stimulate the Scottish economy.

“Along with businesses we have repeatedly called on the UK Government to take urgent action – as it holds key policy levers to do so. That includes expansion of shortage occupation lists, a VAT reduction on energy bills, an extension of the Coronavirus Business Interruption Loan Scheme and other loans.

“For the fourth year in a row, The Scottish Government is delivering the lowest non-domestic property rates in the UK for over 95% of non-domestic properties, and supports a generous package of reliefs forecast at £801 million including offering the UK’s most generous Small Business Bonus Scheme which takes over 111,000 properties out of rates altogether, as of June 1, 2021.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

iStock

iStock