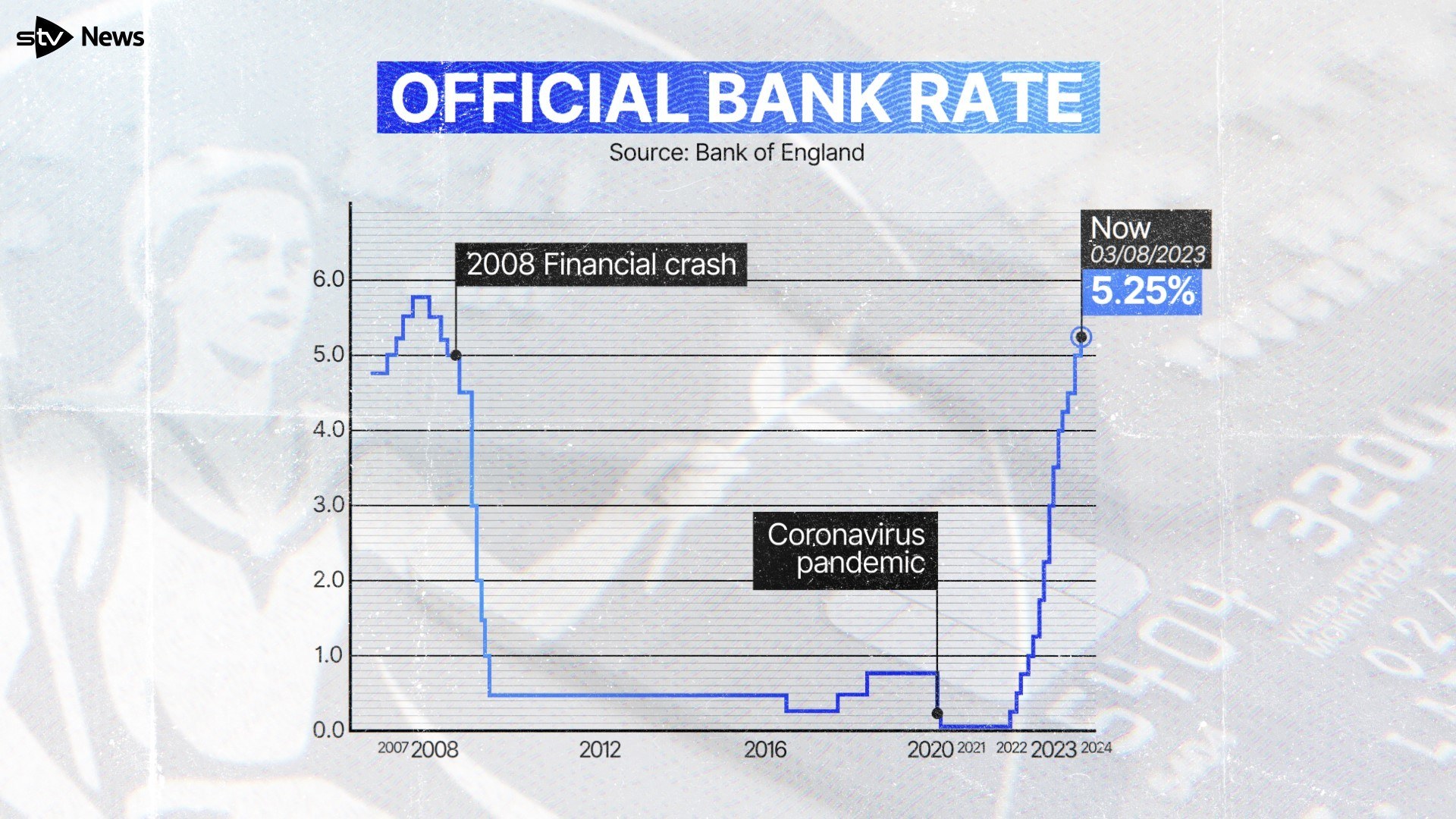

The Bank of England has raised interest rates in a record 14th increase in a row in an effort to get inflation back on track towards its 2% target.

The Bank’s Monetary Policy Committee (MPC) bumped up the base rate by 0.25 percentage points on Thursday to 5.25%.

It comes after a surprise 0.5 percentage point hike in June which brought rates to 5%.

This is the highest level in 15 years and comes after warnings the successive hikes could see mortgage holders lose significant chunks of their disposable income.

STV News

STV NewsBut there are warnings the cost of living crisis has entered a “dangerous new phase” pushing millions to rely on unsecured lending as a last resort to pay for bills and essentials.

With interest rates rising, and inflation stubbornly high, the Joseph Rowntree Foundation said it is unclear how much more pressure the Bank of England’s strategy can bear.

On Thursday, research by Citizens Advice Scotland revealed 41% of people had stopped some level of social activity, such as eating out, over the last financial year, while 23% had given up some sort of hobby.

What is inflation?

Inflation is the term used for the rate at which prices increase over time.

If the price of something rises from £10 to £11 over a year, then that would represent annual inflation of 10%.

Every month, the ONS reports the annual increases on a raft of items and services, including everything from computer games to a loaf bread.

What does it mean for interest rates?

Experts think the latest UK inflation data has taken some of the pressure off the Bank of England, because it showed a bigger-than-expected slowdown in price rises.

Consumer Prices Index (CPI) inflation was 7.9% in June, down from 8.7% in May and the lowest rate since March 2022, according to official figures from the Office for National Statistics (ONS).

It means that rates may not need to climb as high as feared.

In order to drag inflation down quickly, the most commonly used policy tool used by the central bank is increasing the base interest rate.

Increases to interest rates – which currently sit at a 15-year high of 5.25% – are designed to reduce demand from people to borrow money, because of the higher charges they will face, and encourage people to save their cash.

It is hoped that lower spending and increased saving will encourage firms to reduce prices to keep customers purchasing products or services, helping to reduce the rate of inflation.

How are mortgages affected by interest rates?

Some variable rate mortgage deals directly track the Bank of England base interest rate and they automatically increase in line with the base rate.

Borrowers can also end up on a standard variable rate (SVR) when their initial mortgage deal ends. The SVR is set by lenders individually but it can often roughly follow movements in the base rate.

The bulk of mortgaged UK homeowners tend to take out fixed-rate deals.

Swap rates underpin the pricing of fixed-rate mortgages and these have been rising amid expectations around inflation, as it has turned out to be more “sticky” than some had expected.

Fixed-rate mortgage rates have been on an upwards march in recent months, with the average two-year fixed-rate residential mortgage now sitting at around 6.85%.

What are economists saying?

Economists expect at least one more rate hike to come in the months ahead.

The level could peak at about 5.75% this year, according to economists from the likes of ING Economics and Deutsche Bank.

“Beyond this month (August), we’re sticking with our prediction of another increase in rates in September, at which point the present rate rise cycle should come to an end,” predicted Andrew Goodwin, chief UK economist for Oxford Economics.

Meanwhile, Investec Economics predicts the Bank will opt for a bigger 0.5 percentage point increase on Thursday, before pushing through a final quarter-point hike the following month.

It sparks hopes that the mounting pressure facing borrowers could be coming to a head.

Lloyds Banking Group, the UK’s biggest lender, said its customers who will be fixing to a mortgage deal over the rest of the year could face an average £360 increase in their monthly repayments.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The market is now expecting interest rates to top out at 5.75% or 6% by the end of the year, so has already pared back its bets from the height of inflationary panic when rates north of 6% were envisaged.

“The Bank is still walking a tightrope though, as it tries to tame inflation without breaking the housing market.”

The Bank’s Monetary Policy Committee will draw up fresh economic forecasts alongside its rates decision on Thursday, which economists will also be closely watching.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country