The Scottish Tories have urged the Treasury to scrap “cruel” changes to inheritance tax which have angered farmers.

Chancellor Rachel Reeves announced in her first Budget that inheritance tax on agricultural assets will be charged at 20% above £1m, sparking fury among the farming community.

While the Chancellor has said the threshold for some could be as high as £3 million, the Conservatives north and south of the border have attacked the plans.

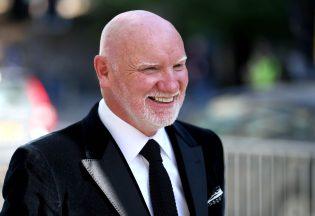

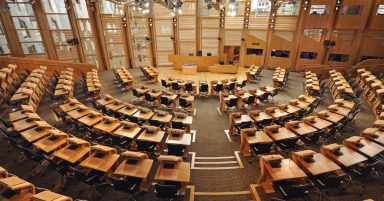

Speaking ahead of a debate in Holyrood on Wednesday tabled by the Scottish Tories, the party’s rural affairs spokesman, and farmer, Tim Eagle, has urged the UK Government to reconsider, claiming the change could “see the end of the family farm as we know it”.

“Labour’s family farm tax is cruel and will have a devastating impact on farming across Scotland and the United Kingdom,” he said.

“As a farmer myself, this is personal to me. That is why I am proud to be leading my party in a debate in Holyrood this week to highlight the huge concerns surrounding what Labour announced in the Budget.

“We’ve heard directly from farmers that this could cripple many family farms. It will mean that families will not be able to pass on their farm to the next generation.

“Labour’s response to the growing anger shows how disconnected they are. They just do not get what this will mean for farmers and their families.

“If they do go ahead, then our future food security will be under serious threat. Without farmers, we do not have food.”

He added: “Labour must listen to farmers and urgently U-turn on their family farm tax.

“I hope MSPs from all parties will join us in sending Labour that message from Holyrood.

“Otherwise, we could see the end of the family farm as we know it.”

A UK Government spokesman said: “With public services crumbling, a £22 billion fiscal hole inherited from the previous government and 40% of agricultural property relief going to the 7% wealthiest claimants, we made a difficult decision to ensure the relief is fiscally sustainable.

“Around 500 claims each year will be impacted and farm-owning couples can pass on up to £3 million without paying any inheritance tax – this is a fair and balanced approach.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

PA Media

PA Media