All budgets and financial statements are an exercise in the art of making headlines and hoping small print details won’t puncture those same headlines.

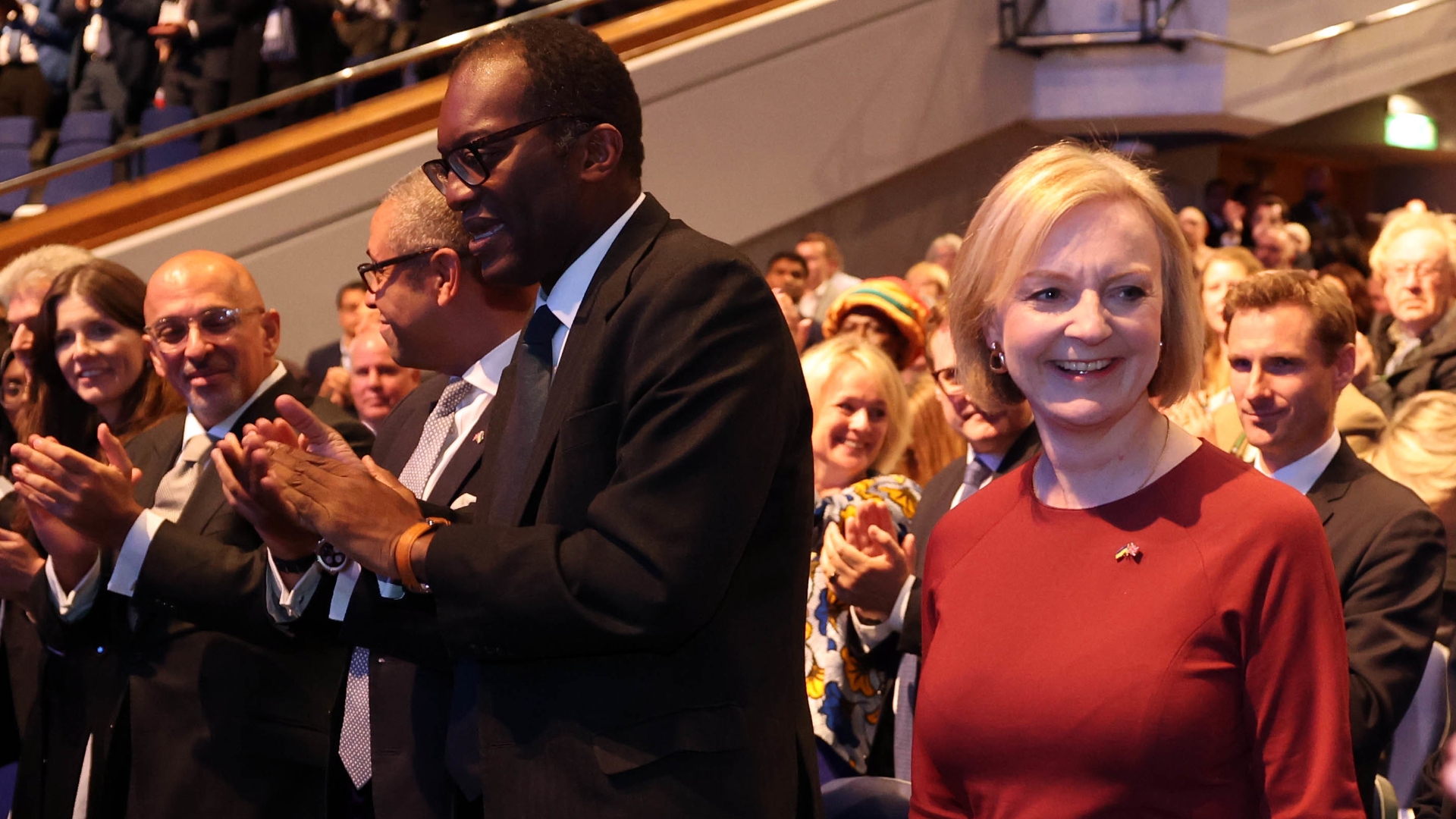

In her speech to the Conservative Party conference yesterday the Prime Minister could not have been clearer. She is a low tax Conservative and wants to see the tax burden fall.

Kwasi Kwarteng’s disastrous tax-cutting budget of a fortnight ago was meant to send a clear message to voters: under the Tories you will pay less tax, hence the cut to income tax, the reversal of plans to hike national insurance and corporation tax and the cut (since aborted) to the higher rate of tax in England.

Spooked by the markets and some bellicose financial warnings from the central bank over interest rates, the government finds it has created a whole series of new problems for itself which are all largely self-inflicted.

A crisis in mortgage repayments is now a near certainty. Liz Truss’s mantra of more growth could be buried by an economy headed for recession driven in part by higher interest rates, which have been a response to the government’s own policies to stimulate that growth.

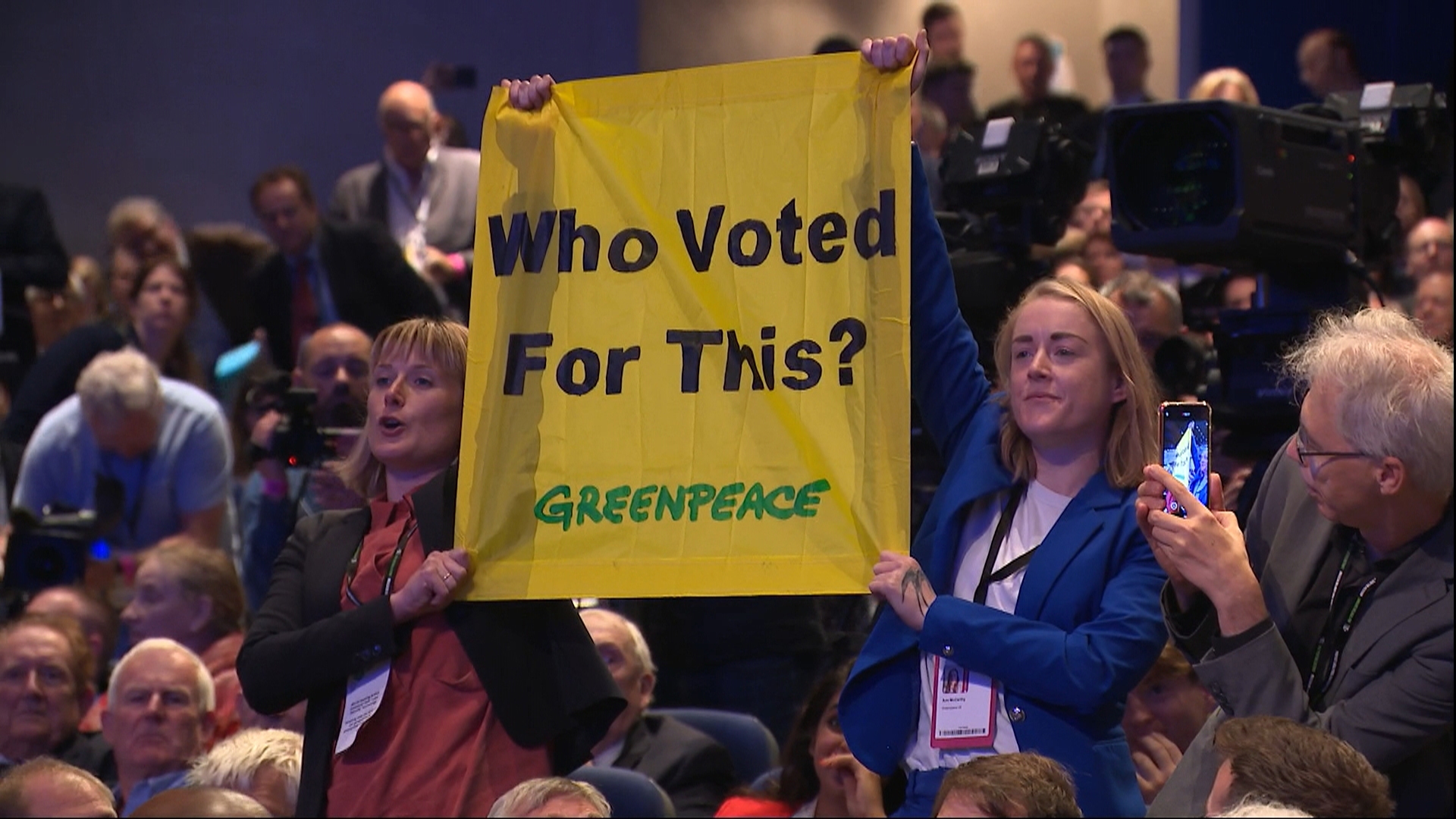

It is little wonder that the right-wing press now contains commentary pieces wondering whether the Prime Minister will be in office very much longer. The shambles of the Birmingham conference, hard on the heels of that budget, is now sending Tory MPs into a state of despair about their electoral prospects.

STV News

STV NewsAlthough the ultimate say in the election of a Tory leader rests with members, it is those MPs who shape the contest.

They were the driving force behind Theresa May’s election before they did the dirty on her after she was given a brief on Brexit that was impossible to deliver.

Then they lumbered the country with Boris Johnson who demeaned the office of Prime Minister in a manner without parallel in recent times.

And then they did the dirty on him before endowing the nation with Liz Truss.

They now openly discuss if she is up to the job. These MPs have a lot to answer for because they have been the prime agents of chaos under three Prime Ministers. They continually seek to save themselves from their own folly.

They know that their prospects rest on a belief (laughable at the moment) that they are competent to run the economy and that they will lower tax.

Today, those pesky irritants at the Institute for Fiscal Studies (IFS) have released findings on the consequences of this government’s decision to freeze tax allowances. The findings, from the Conservative point of view, make grim reading and frankly shine a light that cuts through the smoke and mirrors.

On tax and benefits thresholds, the IFS say: “These freezes, which represent a stealthy and arbitrary way to raise revenue, often have a bigger impact on household incomes that more eye-catching discretionary measures.”

Put simply, you would be better off, not by the UK Government reducing the basic rate of income tax by 1p in England, but by uprating the personal allowance and tax bands by the rate of inflation.

Here are some sobering findings. The tax giveaways from the government will cost £20bn, but the decision to freeze allowances will boost government income by £41bn.

With allowances frozen for a four-year period, more people will be dragged into paying tax for the first time and others will be dragged into paying the higher rate of tax.

The four-year freeze will mean one million people will now pay tax for the first time since the personal allowance of £12,570 won’t be uprated each year with inflation.

In addition, another 1.6 million people who currently pay the basic rate will become higher-rate taxpayers as increases in their salaries move them into the higher-rate tax band which doesn’t increase every year.

The personal allowance of £12,570 was frozen in April 2021. It should be £12,950 if the government had uprated it in line with CPI inflation. By freezing it for four years, more people get caught by ‘fiscal drag’.

The IFS say “all tax and benefit parameters should be uprated by a sensible index” to avoid fiscal drag.

Here is the nub of their findings: “On average for every £1 households gain from high-profile cuts to rates of income tax and national insurance, they lose £2 from the freezes and policy roll-outs. Not only does this hold in total, but in every decile the average impact of gradual roll-outs and freezes outweighs the impact of the explicit discretionary policy changes.”

The personal allowance is UK-wide but tax bands on income are devolved to Holyrood. The IFS figures relate therefore to England, but they nevertheless create an issue for the UK Government.

Later in the year, the Scottish Government will let people here know if tax bands are to change. Higher-rate taxpayers in particular have been hit by ‘fiscal drag’ in the past, so the issue is not just one for the UK Government, although it is more problematic for a party that wears a low tax badge so proudly.

Flickr

FlickrLiz Truss wants people to keep more of what they earn. So why not just uprate allowances instead of cutting the basic rate? The answer is that it is more costly.

The smoke and mirrors are all about convincing people that they are getting more in their salary cheques with a cut, whereas they would in fact have more disposable income by uprating allowances and keeping fiscal drag in check.

So, here’s my question, Prime Minister: what is more likely to deliver the growth you seek, cutting the basic rate or uprating allowances thereby doubling the amount of additional extra cash households have to spend?

Like most, if not all politicians, they will go for headlines, even if the small print makes for uncomfortable reading.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News