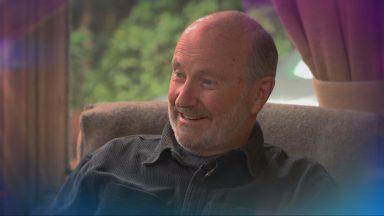

“Nobody likes us. It’s easy to bash us.” The words of the boss of the oil industry body won’t come as a surprise to many and perhaps sum up the feelings of sections of society too.

But there is little doubt in my conversations with those in the sector in recent weeks that, behind the words, they’ve understood the political mood has been changing around them.

It has seen them ramp up their counter campaign to the windfall tax, or the ‘Energy Profits Levy’ as the UK Government would like it to be known.

Time again they have made the point that the industry is already taxed, through various means, by around 40% and more might put off investment and risk jobs.

This new windfall tax – announced by the Chancellor Rishi Sunak on Thursday – will add another 25% on top of what they already pay.

One-by-one, as the likes of Shell and BP announced billions in profits, opposition parties, environmental and poverty campaigners lined up to demand they pay more to help tackle the cost-of-living crisis.

After all, the rise in the oil price has mainly been fuelled by the war in Ukraine and the oil companies haven’t really had to work for this additional revenue.

There is little sympathy among the public for the oil firms as the energy price cap increased in April amid warnings of another £800 rise in October.

The UK Government suggests that the new tax will raise about £5bn over the next year and go towards paying for additional support the Chancellor announced for households.

The sector says it is already due to pay nearly £8bn in taxes this year, or around £279 for each household in the UK.

Deirdre Michie, chief executive of industry body OEUK, said: “This is a disappointing and worrying development for the industry, the shockwaves of which will be felt in offshore energy jobs and communities, and by consumers, for years to come.”

Drill beyond the headlines of the windfall tax, though, and there are some interesting details for both the sector and environmental campaigners alike.

The new tax won’t really be a ‘one-off’ because a ‘sunset clause’ will allow it to run until the end of 2025.

The Chancellor said the levy would be phased out when oil and gas prices “return to historically more normal levels”.

The question is, who or by what benchmark exactly do you decide that and how long would a ‘phase out’ period be?

Then there is the ‘super-deduction’, as the UK Government has called it.

That will be a tax relief if firms invest, but interestingly to “encourage firms to invest in oil and gas extraction” in the UK.

Much of the billions of pounds of investment announced by both Shell and BP were in greener technologies and renewables.

The Scottish Greens called this a “perverse incentive”. They added: “Big energy companies will be allowed to dodge the windfall tax if they spend more money drilling for oil and gas in UK waters, despite clear warnings that the planet is at its tipping point and needs to move away from fossil fuels immediately.”

It has been, politically, a rollercoaster of a year for the oil industry.

Ahead of the COP26 climate summit in Glasgow, the debate was how quickly we could move away from fossil fuels while protecting jobs and demands the pace increased.

However, when Russia invaded Ukraine, it threw energy security into the spotlight and that prompted the UK Government to look at increasing drilling in the North Sea.

Now, these firms have found themselves the target of growing anger among many as bills rise.

A criticism of the oil sector by campaigners is that many big firms don’t pay taxes as they get relief from the government.

But the Chancellor’s announcement includes a clause which says companies won’t be able to offset previous losses or expenditure on things like decommissioning against profits to reduce the tax they pay.

Rishi Sunak likes to think that this tax will both help households and increase the investment of the oil sector in the UK.

The boss of BP has already said a windfall tax won’t impact planned investment, but that doesn’t bring into question anything else they have planned.

Campaigners say, though, that they don’t believe companies that are making billions will really give that up and leave the UK.

This isn’t the first windfall tax we’ve seen, and it isn’t the first on North Sea firms either.

Politically, this has bought some time for the Chancellor, although he has been slow in responding to opposition calls for it.

The reality, though, will be set out in the months ahead to see if, as energy prices rise, this £5bn will be enough and if oil companies decide to turn their back on the North Sea.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

STV News

STV News