A bid to protect Dundee bank branches from closure could be taken to Westminster.

Dundee City Council has agreed to write to the chief executive for RBS formally objecting to the closure of its Broughty Ferry bank.

But it has now been suggested this does not go far enough and calls have been made to write to all major banking groups and the UK chancellor.

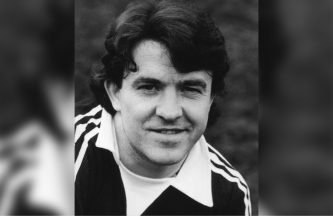

At a meeting of the city governance committee on Monday, SNP councillor Mark Flynn said: “Is there not a case here that we should get the chief executive to write to all leaders of the banks or actually include our MPs to take it further and take it to the chancellor?

“I think we need to go further.”

Council leader Jon Alexander agreed to take the suggestion for consideration next month.

It came after a motion to formally object to the closure of the RBS on Brook Street, raised by Broughty Ferry councillor Craig Duncan.

The branch is due to close in November and a campaign has been launched to save it.

Duncan said: “It’s part of a very unwelcome trend, not just in Dundee but up and down the UK unfortunately.

“In recent years banks are seeking to leave the communities they have served for many a year – but also the communities themselves have served banks rather well for many a year.”

His views were backed by fellow councillors, including Labour councillor Helen Wright, who said: “All our communities have suffered from the bank deciding to closes branches.

“I feel its worth while reminding the bank who supported them during during the global financial crisis, taxpayers generously provided substantial financial support.

“In light of this I feel it’s only fair to expect reciprocation from the banks in the form of support for local communities.”

RBS blamed a significant drop of more than 50% in transactions for personal customers, saying “most of our customers are shifting to mobile and online banking because it’s faster and easier for people to manage their financial lives.”

But the banking giant has been accused of “gaming the numbers” to make them appear lower.

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country

Google Maps

Google Maps