Hotel and B&B owners in Edinburgh say there has been ‘no joined-up thinking’ around tourism planning as the city moves toward introducing its long-debated 5% visitor levy.

The charge, which comes into force on July 24 2026, will apply to all paid overnight stays in the Capital, capped at five consecutive nights.

City officials estimate it could raise up to £50m a year, to be reinvested back into services and infrastructure used by businesses and visitors.

But accommodation providers say that the implementation of the tourist tax remains unclear – with many having to collect the levy on advance bookings from October.

‘It’s crunch time – we need to know what’s going on’

STV News

STV NewsFestival season has arrived in Edinburgh – and the city is teeming with tourists.

By this time next year, visitors will face the extra cost of a tourism levy on top of accommodation bills.

The Council say that cash will be invested in protecting and enhancing Edinburgh’s appeal as a place to live in and visit.

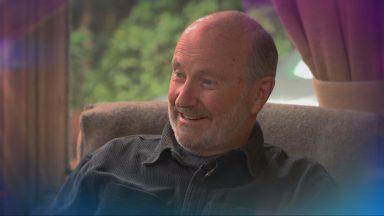

James Marshall runs the Crioch Guest House in Leith, where he and his wife are the only members of staff.

They will need to start taking the fee on advance bookings from October this year – and he says he’s none the wiser on how it’ll all work.

“It’s getting to crunch time,” he told STV News.

“I haven’t heard anything. I have no idea how it’s going and that’s a problem. Even the website hasn’t been updated since last year.

“There are a lot of people like ourselves who need to know what’s going on, so we can have discussions with our guests and prepare them for what’s coming. I want to know more and I don’t think that should be difficult – it’s not a mass infrastructure project.”

‘Small business owners need a break’

STV News

STV NewsEdinburgh is not the first popular tourist destination to charge such a levy. Rome, Barcelona and Amsterdam are just some of the European hotspots that have brought in a tourist tax over the years.

Closer to home, both Manchester and Liverpool brought in smaller-scale levies for hotels and serviced apartments of £2 and £1 overnight in 2023.

But Edinburgh’s scheme is the first to cover every kind of accommodation, using Scotland-wide legislation that was passed last year.

James said the levy adds an “extra layer” of costs to Edinburgh’s tourism sector, following the introduction of short-term let licensing laws, and that businesses “need a break.”

“We’ve had lots of certifications – safety, electric, gas testing, water quality, smoke and carbon monoxide.

“All of those add costs, but the guests don’t really see that. Now they want to add 5% on top of that.

“Lots of people like ourselves have been going for many years, decided this is too much and they give up and sell up.

“We’re still going. We’ve done the work, we’re busy and people are enjoying their stay – but lots of people outside the cities run a much more marginal business. They don’t have the year-round custom.”

James added: “There’s not been joined-up thinking in tourism. They see it as something to be harvested and they forget about the effects on real people and their livelihoods.

“It’s really something that we’re already some of the highest taxed tourist accommodations across Europe.”

Council: ‘We’re working closely with the industry’

STV News

STV NewsBut the City of Edinburgh Council say the visitor levy scheme has not changed since being published in January and insists all information on the website is up to date.

The development of a digital platform which will be used for collections is said to be running to schedule, with training and sign-up pencilled in for spring next year.

The first returns and payments on the levy won’t be due until October 2026.

Council Leader Jane Meagher said: “With one year to go, we’re working closely with industry, government, and VisitScotland to continue our preparations for the levy’s launch.

“This is a once in a lifetime opportunity to invest tens of millions of pounds towards enhancing and sustaining the things that make our city such a great place to visit – and live in – all year round.

“We’d be expecting to raise almost £5m in August from overnight visits to our annual festivals and events like Oasis. Hosting these visitors comes with fantastic economic benefits but it also puts pressure on the city.

“We’re also looking forward to making detailed spending decisions at Council Committees – with input from our newly established Visitor Levy Advisory Forum – so that we can get moving quickly in delivering the many benefits Edinburgh’s visitor levy will bring.”

‘We need a detailed roadmap’

STV News

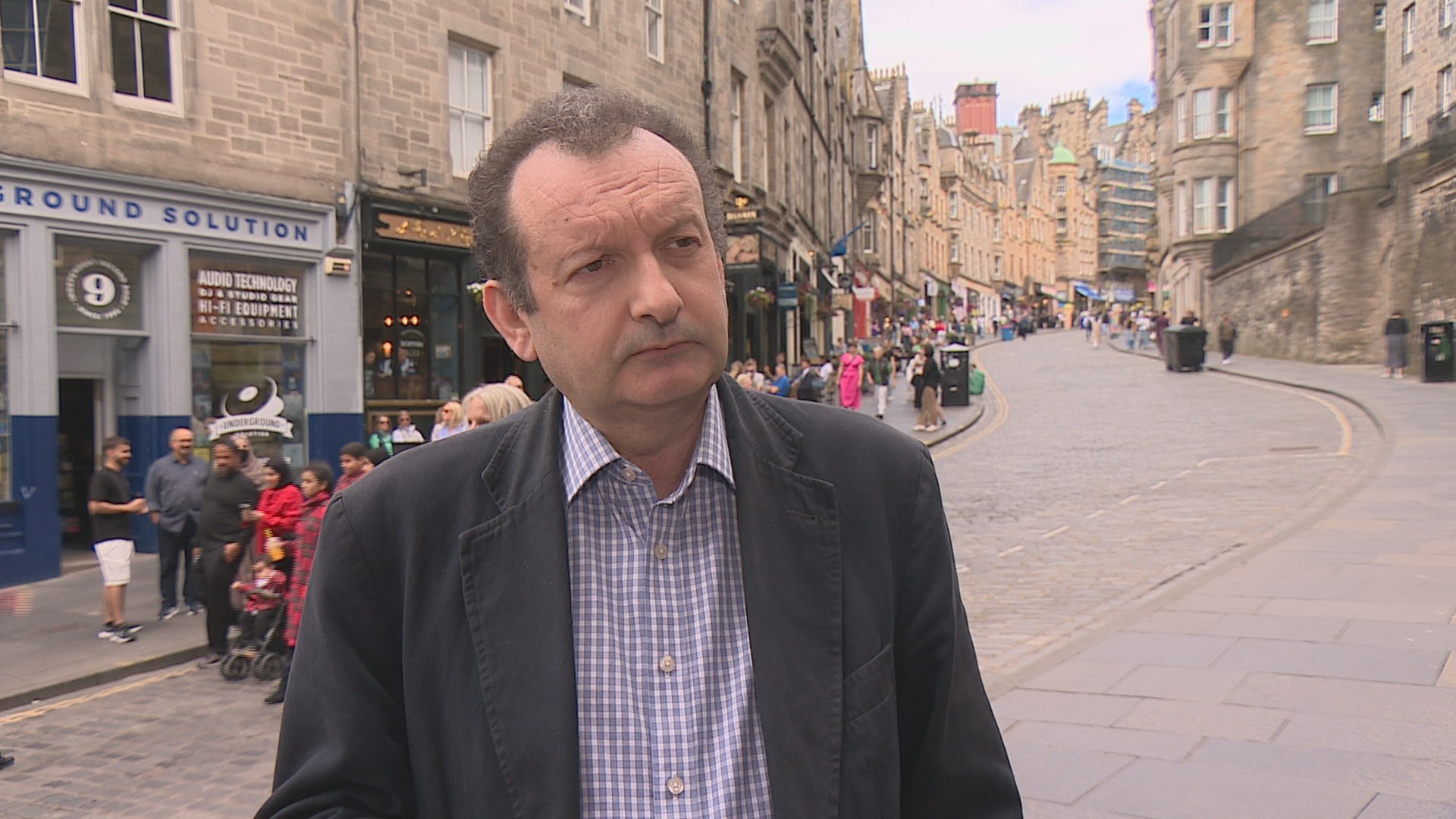

STV NewsThe Federation of Small Businesses say that such a large scheme should have more thorough and detailed guidance – especially with the requirement for charging the levy on advanced bookings looming large.

They fear without this the implementation could be a “disaster”.

Development manager Garry Clark said: “Here we are in the middle of festival season, and there’s still no information about what businesses need to do in just nine weeks’ time. That’s a real concern.

“We need to see a detailed roadmap published by the council, letting businesses know every step along the way – what they need to do, when they need to do it, and the advice they need to give to their customers. So that the levy is paid on time, transferred to the council, and spent appropriately.

“We’ve seen more and more small businesses that really like the idea of raising money locally and spending it locally to improve the visitor experience.

“We all want to work towards that. But it needs to work for everyone.”

Follow STV News on WhatsApp

Scan the QR code on your mobile device for all the latest news from around the country